Quick overview of recent developments & emergent risks for Cipher & Moberg Pharma; a note on Sygnity SA's most recent acquisition

There’s been a few developments in these last couple of months that are worth covering here.

It’s probably most appropriate to start off with Moberg’s official launch in Sweden given this was the content I used to launch a paid newsletter.

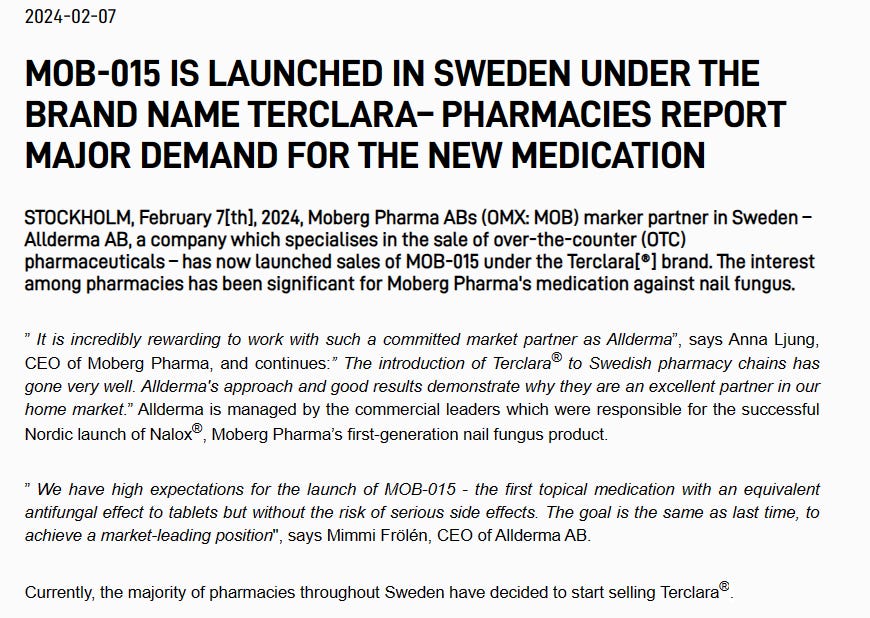

Starting at the beginning of February, the company announced that it had begun selling Terclara.

This wasn’t exactly news for people with eyes close to the story, as first pieces of evidence of the product being sold occurred in early January, a full month earlier than the company announced.

How much has been sold and what Moberg’s take from Alldermas sales is currently indeterminable. However, we do know a few things.

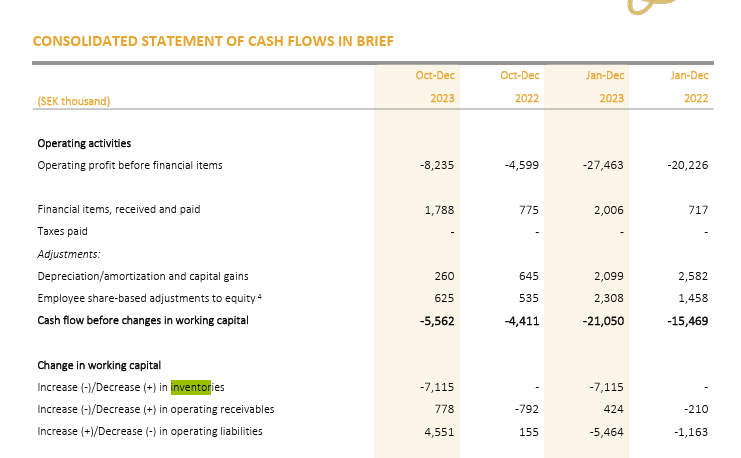

Moberg has spent less than $1M USD on initial inventory build. This can help you pencil some assumptions on how many units they actually shipped on launch.

The company is looking to bring on an additional supplier of terbinafine in the near term. Note there’s a moderate delay here as supplier’s product must be first tested to enter a commercial setting, which is a process that I’ve read takes around ~6 months once the first supply is received.

Allderma is going to launch a TV commercial in April and online advertising by Allderma likely started today.

Now - beginning with some of the risks…

Something came to my attention recently that I think is probably a good point for risk in the North American market.

From what I’ve seen thus far, right around the time Terclara will be going to market in the US, initial generic entry of Jublia (Efinaconazole) will start to become possible, and a number of manufacturers of generics already have these products ready on standby. This will obviously result in a dramatic decrease in price of a primary competitor in their most valuable market. In terms of insurance this probably matters quite a lot— Jublia has spotty coverage and with generics soon coming to market, patients could first be prescribed a generic version of Efinaconazole prior to being prescribed Terclara.

Luckily the largest cohort of patients is also the wealthiest population in the US.

The other risk was already sort of mentioned — the time it takes for Moberg to get an additional supplier of Terbinafine up and running is not a short period of time, so if for some reason this new supplier falls through, it’s going to result in an additional ~6 months of delays (to be conservative).

Now for Cipher…

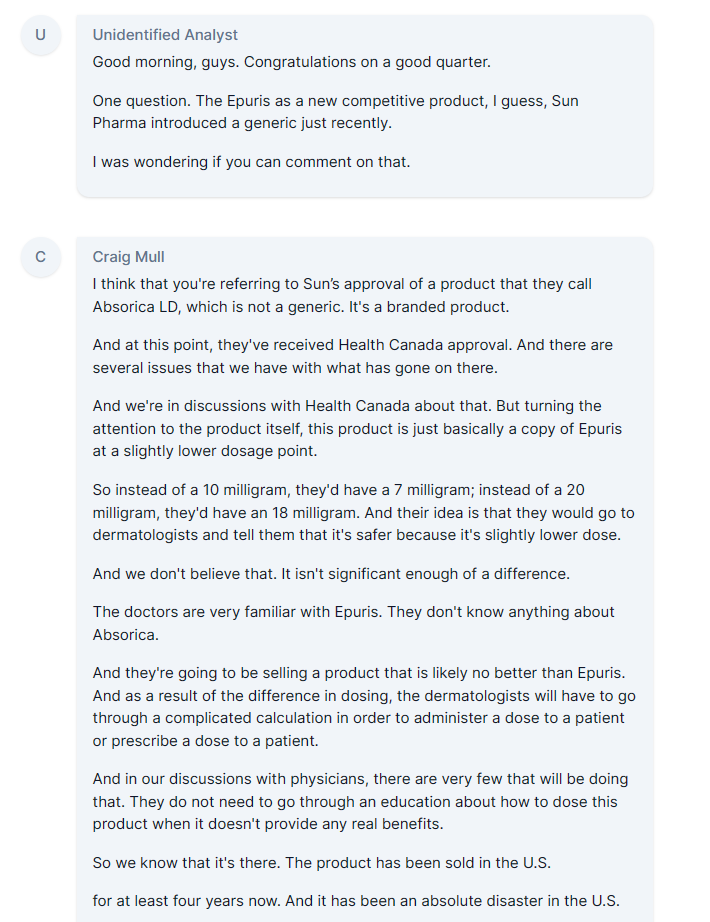

I’ve mentioned it once before, but Absorica LD launched in Canada somewhere in the middle of December of last year. It’s not going to show up on the next quarterly report, but there’s a chance this eats into Epuris’s market share.

Management has commented on this — and their opinions were shockingly strong. They’ve essentially gone on the record stating it will fail.

It’s great to see they’re confident about this. Although if they’re wrong and it starts to hit the financials starting in Q1 of 2024, I’d expect the stock to react quite negatively.

Finally, for both of these positions — since I began covering these, both stocks have more or less doubled in price. This implicitly raises the risks going forward.

Sygnity announces a ~€10M acquisition.

I wrote a relatively short post about this company a couple months ago.

There wasn’t particularly a lot of analysis in this post, but rather a drawing attention to the company and what’s been happening and some implications for Sygnity remaining public. Which at this stage (in my view) it’s far more important to be directionally correct than to nail any sort of multiple expansion.

Fortunately for shareholders, today, the largest acquisition Sygnity has done thus far was announced.

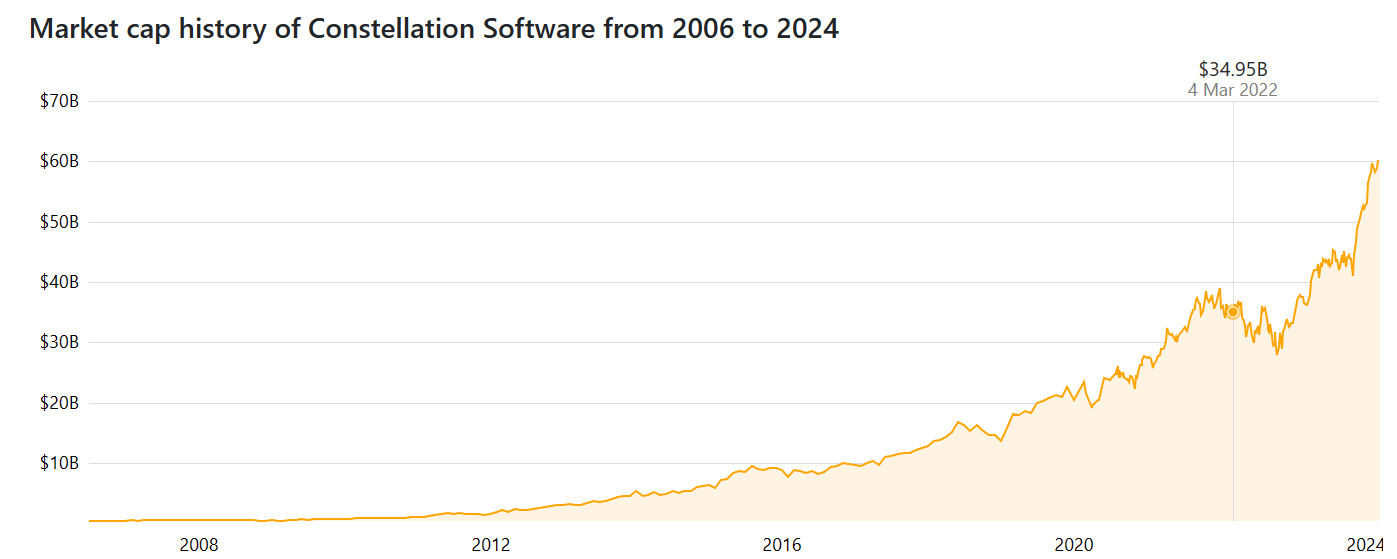

This transaction represents slightly less than 4% of Sygnity’s market capitalization as of the close. Or roughly 2x the relative size of the Allscripts transaction near the date that acquisition was announced.

This may seem like a lazy comparison to make, but I think in general it’s a valid one on a go forward basis. If you expect practices to carry over from constellation, the characteristics of these businesses and the pricing discipline of any M&A should be fairly similar.

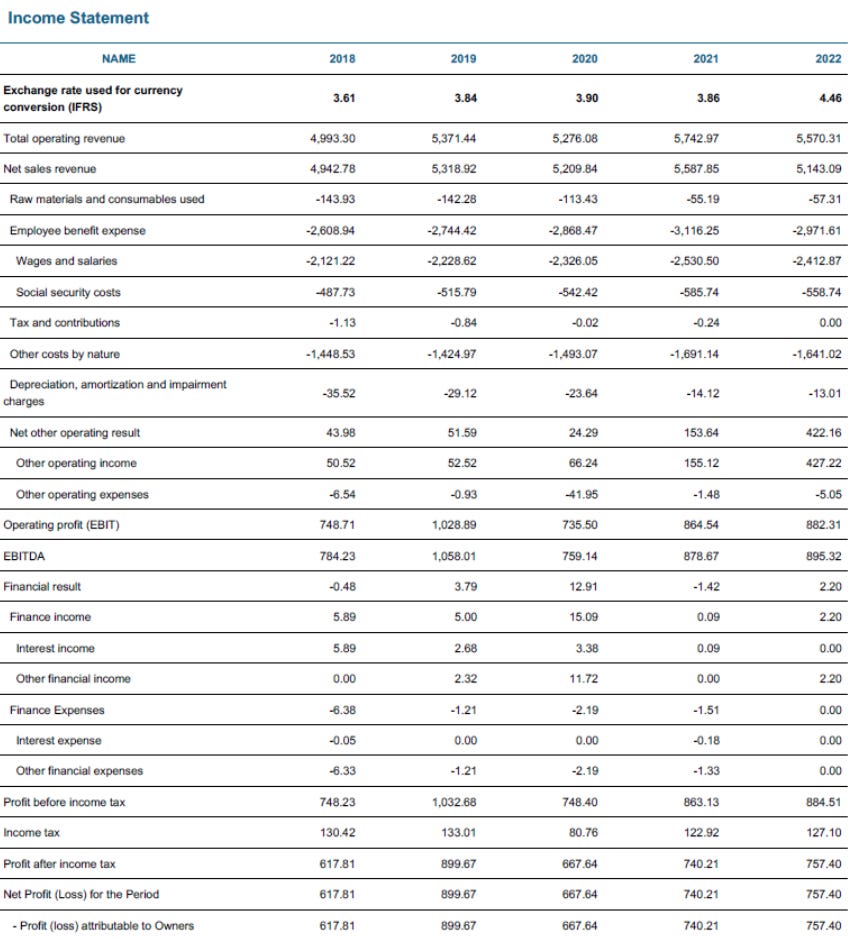

The following data is from EMIS

It appears a % of the acquisitions will be for cash, there’s a small amount of organic growth (single digit), and the price being paid is somewhere in the range of 1.6-1.8x sales.

For paid subscribers, recently (February 13th, 2024) an interview was conducted with Moberg Pharma’s CEO. The following information lays out their internal plans on a timetable from 2024 to 2027.