Moberg Pharma

“Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.” ―Archimedes

“The tale upon which the modern Olympic Marathon rests is the mythic run of Pheidippides from Marathon to Athens. He was a professional messenger and, in 490BC, is supposed to have brought a message from the plains of Marathon, where the Greek Army had just won a crucial battle against the invading Persian Army of General Datis. After the battle, in which he may have taken part, he was dispatched to Athens to deliver the news: “Rejoice, we are victorious”. He did this, and no more, dropping dead with the delivery.”

2014-09-18 - Moberg reports positive MOB-015 Phase II trial results in patients with onychomycosis.

2023-06-28 - MOB-015 IS RECOMMENDED FOR APPROVAL IN EU

2023-06-28 - MOBERG PHARMA RESOLVES ON A RIGHTS ISSUE OF APPROXIMATELY SEK 100 MILLION

2023-06-26 through 06-29 - Moberg’s shares fall -52.50%.

One of the greatest risks to investors of small companies isn’t business failure. It’s the risk of dilution. It won’t matter if your company ultimately succeeds should a shareholder undergo too much dilution in the process. At a certain point your losses begin to crystalize, and your paper losses turn into a permanent loss of capital.

This is partially what happened to Moberg. And it happened at the finish line of a metaphorical marathon, where Moberg has positioned itself over the last ten years to potentially take over a market earn hundreds of millions to billions of dollars in royalties in the process.

“This little piece of gum is a three-course dinner.” - Peter Wolpert

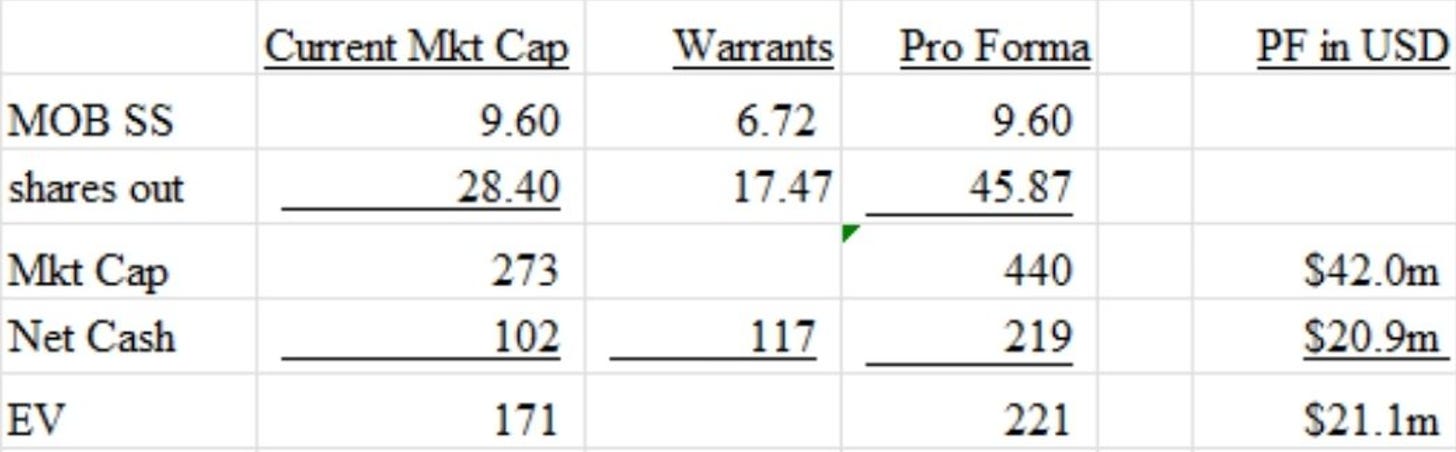

As of 11/14/2023 (In $ M USD):

Price: $0.71 USD/share

Fully diluted upon exercise of warrants

Description of company:

Moberg Pharma is a single product, pre-revenue clinical stage pharmaceutical company which is responsible for the development of MOB-015, a topical medication for the treatment of onychomycosis. It is the most clinically successful topical medication for the treatment of onychomycosis ever tested in humans, and it remains the only medication to have ever exceeded the mycological cure rate of oral terbinafine during human trials (having reached a mycological cure rate as high as 84% in a European trial).

Once this product is on the market, oral terbinafine will have finally passed the torch of being the gold standard for the treatment of onychomycosis onto Moberg with the added safety of being a topical medication - more on this later.

If you have been reading the blog, you should be somewhat familiar with the product. If not, I recommend reading my initial and follow on posts on Cipher Pharmaceuticals. Put into context for investors in $CPH.TO, Moberg Pharma is an instrument to dramatically increase the amount of exposure on the primary growth catalyst inside of Cipher Pharmaceuticals. This is due to a combination of its present valuation, the underlying potential of the asset, and existing milestone payments, which currently sum to ~2x and ~3x greater than the current enterprise value and market cap respectively.

Partnerships

Moberg has licensed market exclusivity of their drug to several companies. The drug has been approved in the majority of countries in Europe and the final topline data readout from the second phase 3 trial in North America will happen in January 2025.

Moberg is working with the following companies which it has licensed market exclusivity of MOB-015 to:

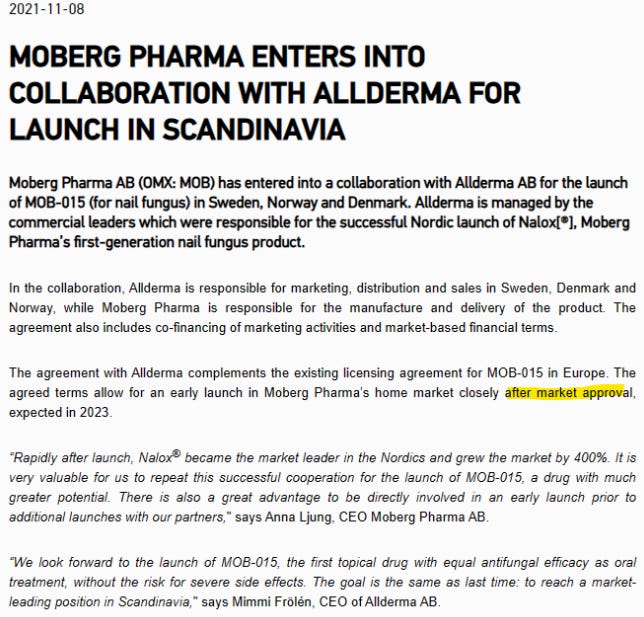

Allderma in Scandinavia

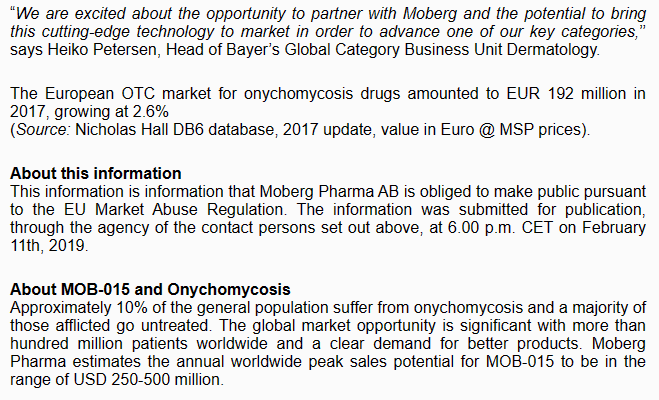

Bayer in Europe, ex Scandinavia - €48.5M in milestones remaining

Bayer is the largest seller of OTC toenail fungus drugs in the world. MOB-015 will be sold under the Canesten® brand

Cipher Pharmaceuticals in Canada - $10M USD in milestones remaining.

DongKoo in the Republic of Korea

This is the largest dermatology group in Korea.

Padagis in Israel

This is a newly formed corporate entity. The company was spun off from a transaction in 2021 when Altaris acquired Padagis from Perrigo for $1.55B USD.

“The Company has secured agreements for the commercialization of MOB-015 with a combined value of milestones of up to USD 70 million, of which milestones of USD 6.5 million have already been paid, in addition to compensation for delivered products in Europe, Canada, Israel and South Korea with market leaders.” The majority of this (€48.5M) will be coming from Bayer.

Moberg will also be receiving royalties from the net sales of the drug. The figures pertaining to royalties haven’t been disclosed, but we’ll largely know what they are in the next 24 months.

Direct marketing

Moberg has maintained commercial rights for the US, where Moberg plans to market the drug directly as a prescription & OTC. According to statements in their annual presentation, the company does plan to work with independent sales teams in the US to sell the product but without licensing the drug to any one group. The company has also been returned its rights to the Japanese market as Taisho Pharmaceutical Co backed out of their licensing agreement with Moberg this year in March after Taisho initiated a ‘strategic review of their pipeline’. It’s not yet clear to me why Taisho may have backed out of this agreement. It’s possible that they didn’t want to have to pay an additional 45M USD in milestones to Moberg, but this is speculation. I’ve contacted the single Japanese investor I know to see if he can dig anything else up, but he hasn’t yet had adequate time to discover anything. It’s unclear if they plan to maintain marketing rights or relicense the product in Japan.

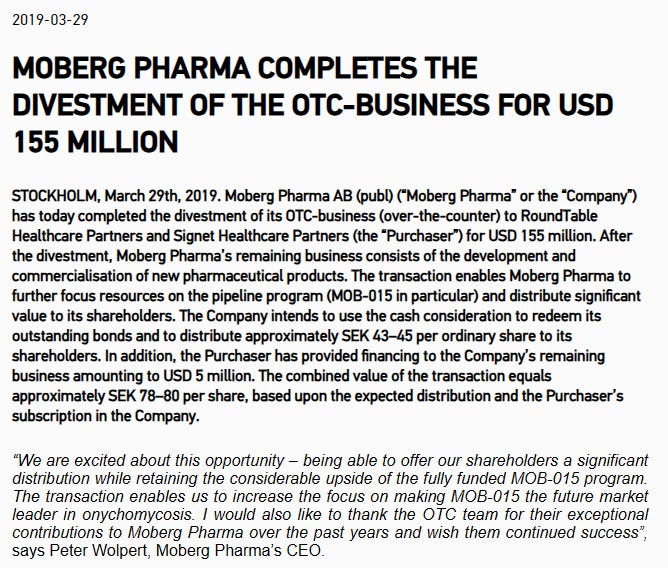

In the US the company is taking the same path it took over a decade ago with Kerasal Nail, where they built a sizeable OTC business, with annual revenues of 440 million SEK, a 30% market share in the U.S. and more than 30,000 sales locations, including CVS, Walgreens and Walmart. In 2019, the OTC business was divested for 1.4 billion SEK to RoundTable Healthcare Partners and Signet Healthcare Partners “in order to focus on MOB-015.” More on this later.

As I write this the very first initial quantities of commercial product should be getting prepared for sale by Allderma in Scandinavia.

Pricing & market size

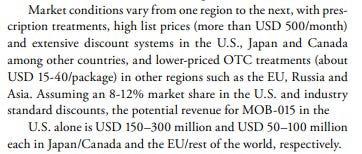

MOB-015 will be sold for the equivalent of ~$500 USD in America, & $100 CAD in Canada as a prescription, and at a discounted rate of $15-40 where the drug is permitted to sell OTC. Jublia and Kerydin are primary topical competitors to MOB-015 that are currently on the market, and they currently sell for over $500/month per script in the US, per Moberg’s annual presentation from 2022.

Moberg estimates their target end market in the US with an 8-12% share (which is their stated goal) to be worth approximately $150–300M USD, selling 400,000-600,000 units annually, and $250-500M USD worldwide.

These estimates are of particular interest to me for three reasons:

Cipher Pharmaceuticals is signaling they wish to largely replace Jublia as the market incumbent, which has a ~90% market share in Canada.

Kerasal Nail, a product developed and grown by Moberg, achieved a market share in the US that’s 2.5x greater than Moberg’s estimate.

This will be the most clinically effective drug on the market for actually curing a patient of their infection.

This is a very interesting dichotomy between the two partners. As should the future more closely align with Cipher Pharmaceuticals vision for the product, it’s not an exaggeration to say that Moberg could earn billions of dollars in royalties over the next several years.

The cause for Cipher’s beliefs likely coincides with the differences in mycological cure rates between existing topical medications such as Jublia VS. MOB-015, & the magnitude of market share Jublia was able to capture as a clinically inferior topical medication. While this market dynamic doesn’t exist in every market Moberg aims to sell into, it is an encouraging thought.

Description of condition

In total, roughly 10% people in the world are infected with onychomycosis. It disproportionately impacts elderly people, and it has a high degree of recurrence once a nail has been infected (with recurrence varying from 6.5% to 53%). This is due to a combination of lifestyle factors, comorbidities which leave a person more prone to infection, and the difficulty in completely eliminating the fungus from a nail.

One reason the condition is more common in the elderly involves other diseases/conditions which increase the risk of contracting nail fungus infection, such as diabetes or peripheral arterial disease.

Patent Status

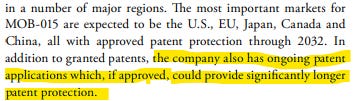

Their drug has market exclusivity until 2032. However, Moberg claims they’re working on additional patent claims that will ‘dramatically extend their patent claim'.

Important notes on product

When initially reading about the product you will see that there is a difference between the “complete cure rate” and the “mycological cure rate”. This is because a complete cure rate factors in cosmetic appearance to the calculation after the observation period is concluded. This has incorrectly led some to assume that there’s trial risk for the product, like Nordea Equity Research. What this is being caused by is a hydrating property of the vehicle, which is resulting in the nail absorbing excessive amounts of water temporarily discoloring the nail and thus resulting in low complete cure rates at the end of the observation period. The nail eventually returns to a normal appearance just as the skin on your fingers returns to normal when you get out of the bath.

To attempt to combat this, Moberg is doing an abbreviated dosing regimen in the final North American phase 3. Should the mycological cure rate come out to a similar rate in prior trials, this is going to confer significant competitive advantages to Moberg’s product as one of the difficulties in treating the condition is patient compliance with drug protocol as daily application for an entire year is the standard in topicals. I expect this attempt at an abbreviated application to largely work, as in prior trials, 56.6% of patients which experienced mycological cure had negative cultures by week 12. In my view, this is the single largest competitive advantage of the product.

BENEFITS & COMPETITIVE POSITIONING TO ORAL MEDICATION

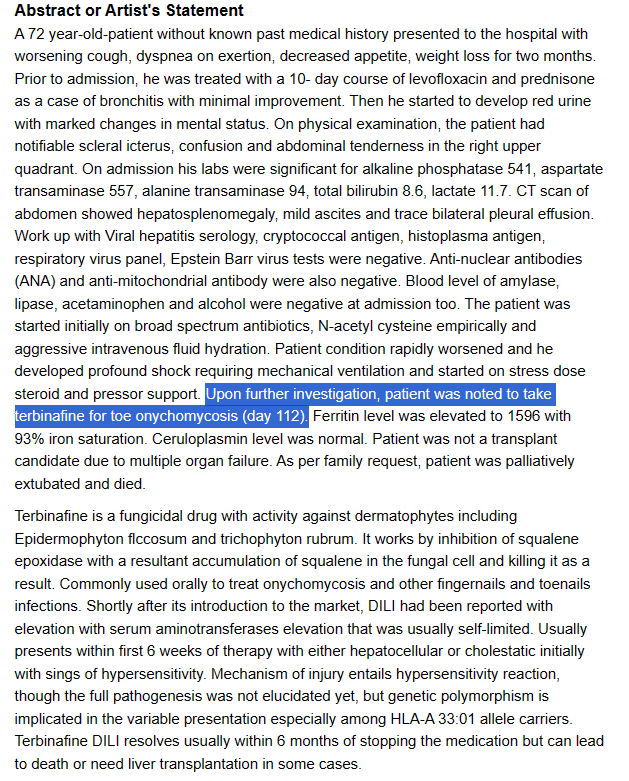

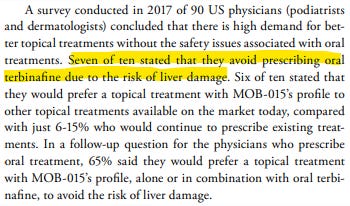

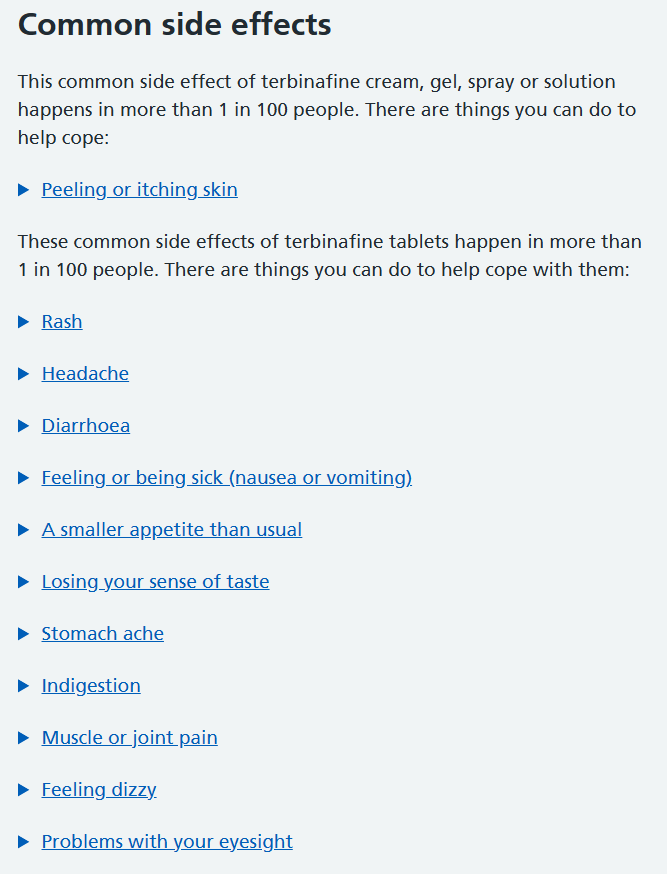

Oral terbinafine (Lamisil) is the most clinically effective treatment currently on the market for the treatment of onychomycosis. However, the drug comes with substantial drawbacks that prevent most dermatologists from prescribing the medication to patients. One of these side effects, although rare, is acute liver failure which can obviously be fatal.

Pictured - Survey data from US physicians.

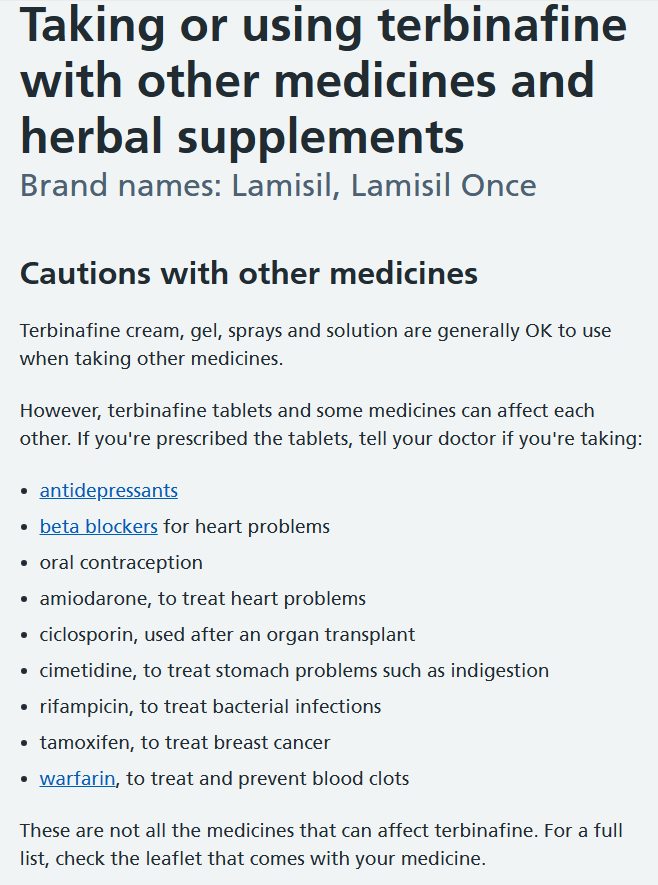

Assuming a patient could get by with the side effects of the drug, there are interactions with common prescriptions that prevent the use of oral terbinafine. Considering the fact that the majority of patients who have onychomycosis, these drug interactions limit the # of individuals that can be prescribed Lamisil.

Beyond the recent status of approval in Europe, or that MOB-015’s mycological cure rate is at a minimum equivalent to that of Lamisil (oral terbinafine), it’s these safety benefits and the fact Lamisil is already being sold which has my confidence that basically every jurisdiction where the drug is submitted it will be met with regulatory approval.

RISKS:

DILLUTION - This is the greatest risk for Moberg as I see it at this time. The company is still burning cash, and should a substantial delay related to the manufacturing and sourcing of terbinafine occur, this could result in the need for Moberg to raise additional funding. In the prior 9 months cash flow burn was elevated by the enrollment of patients/payments to the CRO for the final North American that won’t be recurring, so I think the picture for their burn rate is likely not as dire as trailing numbers make it seem.

MARKET FAILURE - This is going to vary by market. Different corporate entities are marketing the drug in different countries. Canada is almost entirely dominated by Jublia, but in the US Jublia has a fairly low share of the market. Bayer’s skill and capacity to market a drug in Europe is also going to be different than Moberg’s capacity to market their drug in the US or Ciphers in Canada, etc., etc.

REGULATORY FAILURE - While this is possible in the remaining markets where the drug isn’t approved, of all outstanding risks, this seems the least likely. We have precedent with the EMA’s approval that medical regulatory bodies find the drug’s safety satisfactory. On top of this, Lamisil (oral terbinafine) is an approved medication, which comes with substantially greater risk. On the side of regulation, the greatest current risk in my mind relates to permission to sell the drug OTC. While prescriptions offer a substantially higher unit price, OTC sales offers the greatest opportunity to sell the product in bulk through retail distribution centers like CVS, Walmart, Walgreens, etc.

CONTRACT RISK- At this point we don’t know what Moberg offered in terms of their share of royalties. It’s possible (albeit unlikely) that Moberg signed onto these agreements without securing a material % of net sales as royalties.

EMERGENT COMPETITORS -

P-3058 - Polichem (Almirall group) - This is the leading emergent terbinafine product. Its mycological cure rate trails MOB-015 by a small margin (68.82% at week 64 and 72.13% at week 76 versus MOB-015 achieving a ~76% mycological cure rate by week 52). The average nail involvement (the quantity of the nail that’s diseased) is slightly greater in Moberg’s trials (~60% average versus 50%). It’s difficult to say whether or not this is a substantial difference or not, but I believe it is fair to say that Polichem likely represents the greatest competition to MOB-015 as an emergent topical asset. Their Canadian partner Medexus Pharma claims they intend to submit the drug for marketing approval in 2023, though nothing else has been announced thus far.

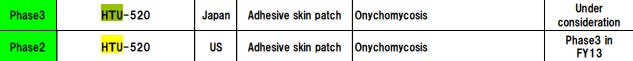

HTU-520 - Hisamitsu Pharmaceutical Co., Inc. At present the asset is absent from their pipeline, and I had to go back to 2013’s investor presentation to find information regarding the drug.

TDT 067 - Celtic Pharma. Its website 404’s. It’s hard to find much of anything on the company. This appears to have been owned by a private equity firm, so my presumption is the money to support development of the drug has been withdrawn.

BB2603 - Blueberry Thereapeutics - This product has some recent news available and it’s clearly still active as Blueberry is moving ahead with a phase 3. As of 11/15/2023, trial results from a phase 2b study were posted 2 days ago. In my view the results are pretty terrible as they only achieved a 30.6% mycological cure rate by week 52.

REASONS WHY THE OPPORTUNITY EXISTS

Management has made some terrible capital allocation missteps in recent years which have cost shareholders dearly. In 2019 they completed the divestment of their primary asset, Kerasal Nail, and they made a large subsequent dividend payment from the proceeds. The business was essentially looted of its cash flows and the working capital it needed to fund operations until MOB-015 came online. I’m sure current shareholders would very much have appreciated having the additional 80 million USD on the balance sheet or an asset that was paying the companies bills over the last four years. Had this dividend never taken place or had their only productive asset not been sold off, there would have been precisely zero need to raise capital.

Management has been signaling a market value of their drug to investors that is adjusted to an instance of them capturing a minority share in every single market. In the case of the United States, their target is 8-12%, which they attach a $150-300M USD market value to. While in markets where Moberg is performing direct marketing it may make more sense to be conservative about their products outlook, these numbers aren’t especially different to what they seek to achieve in Europe where Bayer, who is the largest seller of OTC antifungal medications in the world, is responsible for marketing and distribution. It may seem silly, but if a person doesn’t think carefully about how they’re presenting these figures they won’t catch this.

What I find especially funny about this is that in the same press releases with Bayer lauding Moberg’s product as cutting-edge product, they go onto presenting a very tepid outlook on the products future market penetration.

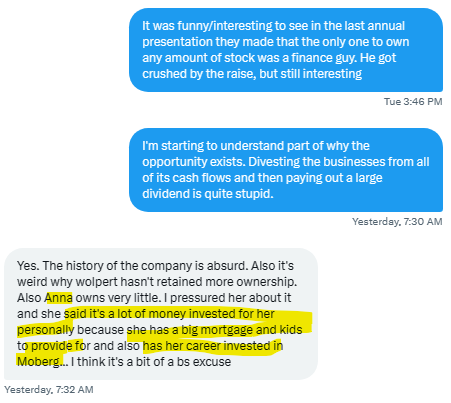

Management owns almost no stock, leaving a free float of essentially 100% after two highly dilutive capital raises. The lack of insider ownership along with the poor stock performance gives little in the way to signal confidence to the market. And given many investors treat insider ownership as a hardline requirement (as who could possibly have better insight to a company than its own stewards?), and even fewer invest in cash burning nanocaps in the pharmaceutical industry, there’s essentially no marginal buyer for this stock until cash flows reappear. I talked to someone who spoke to Anna Ljung (the CEO of Moberg) who described ongoing personal financial struggles combined with career risk. This is something I could very well believe unlike my Swedish friend, but it’s quite bizarre that it’s a similar case across their entire management team. It could be that after the massive dividend + two subsequent raises which sent the stock 98% lower, their perception of the value of shares is succumbing to cognitive biases.

There’s still dilution risk, which along with managements prior incompetence in managing their finances, is leaving investors either out of the market entirely or with far more conservative positioning than they would otherwise have (including myself). Although in some ways this may not be an entirely rational position to take as even if the common stock were to be diluted by a further 50% and presuming the stock price didn’t fall at all, there would still be material upside to be gained simply from realizing Bayer’s milestone payment. The market capitalization is largely unchanged in the prior three years over two subsequent raises, so I expect this would not be case.

Open Questions

What does the regulatory process look like for MOB-015 in Korea and Japan? I’ve found some difficulty in finding material related to the regulatory status/approval of the drug in these countries.

How do drugs which sell large volumes of discounted product OTC (relative to the price a prescription would bill insurance) fare when a product goes off patent?

Why did their Japanese partner back out of their licensing agreement with Moberg?

Useful links:

Novel and Investigational Treatments for Onychomycosis

Suspended Research Moberg Writeup

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I hold a material investment in the issuer's securities.

great note man. the ownership situation is weird to me but to your point is probably part of the opportunity. i was reading their press releases about the rights issue and i was struggling with this a bit but i think the diluted share count pro-forma for the rights issue went up an additional 17.5mn bc of the costless warrants. so i was using 46mn shares and usd 35mn mkt cap. dont think it chgs the story materially but figured id point it out and see if i was wrong about that

1. "Kerasal Nail, a product developed and grown by Moberg, achieved a market share in the US that’s 2.5x greater than Moberg’s estimate."

This seems absurd, why would Management think this?

2. "This is due to a combination of its present valuation, the underlying potential of the asset, and existing milestone payments, which currently sum to ~2x and ~3x greater than the current enterprise value and market cap respectively."

Is the 2x-3x the milestone payments and the potential of the asset, or just the milestone payments?