Death & Taxes - betting on the inevitable

An overview of an industry to possibly insulate from demographic risk and ride the long-term wave of increasing mortality rates in an aging population.

I know this blog hasn’t really ventured into the topic of portfolio construction, any type of thematic investing, or what I’m even intending on doing. But today alongside these pitches I’m going to (briefly).

Something like 15-20% of my net worth today is in low-cost passive instruments exposed to large caps. It’s something I continually add to with new income (whether from capital gains and earned income). I view this passive segment of my own portfolio as capital that won’t disappear, and I simply hope for a moderate return in excess of inflation over my life. I’m not worried about market cycles or macro, or anything related to timing for this money. It’s just not something that’s worth spending time thinking about.

This isn’t what someone should do if they want to be rich, but it’s plenty enough for me & I basically view this as my real security net. Should I be fortunate enough to win, I won’t be upset that I could have made more.

Of this same vein, all of the companies I’ll be discussing today probably don’t have room for a major degree of outperformance going forward. The best performing on a 10-year trailing period is modestly outperforming SPY and it has underperformed over the last 5 years.

The structure of the content is largely a generalization of the sector and then pointers to company specific circumstances when applicable.

What is this blog?

The aim for the content of this blog is non-specific. I’m basically a drunken sailor wandering around the world. I have no idea as to what I’ll find or write about.

The only content I promise to follow over the next couple years is the launch of Terclara. Beyond this, what you will actually get out of here is the research that I’m already doing and find interesting, albeit at a faster tempo and actually written down. For what I’m really interested in there will be audio/video interviews.

As an example from written in late 2022, at the time of writing Power REIT was down around 95% from ATH. Possibly cheap enough for asset-based investors.

When reading about what happened, I noted a Paula Poskon resigned from the board of directors. A member of the audit committee stepping down months after a stock started tanking. Seemed interesting, so, I started to pull the thread.

It didn’t take long to understand what went wrong…

Signal was buried in a resignation letter submitted from former board member of the audit committee. What it hinted at was that management was ignoring their fiduciary responsibility for purposes of self-enrichment.

Now I realize that after discussing microcaps and nanocaps like Cipher Pharmaceuticals and Moberg Pharma where I’ve been hunting for exceptionally high rates of return, talking about a far more well covered industry & business may not be particularly attractive to my existing readers. But to further align my readership with what this blog is, I hope it can be.

I recently had a call with a reader who suggested to just focus on doing good work and be invariant to the outcome because I can and will make mistakes (see Medexus Pharma). Unfortunately, there are so many of you now that when I send these out my anxiety still goes through the roof. But just know that I try my best and that I’m eternally grateful for what you’ve enabled. It’s a privilege to call this my job.

Given these are bigger listings where there’s no real barrier to liquidity and the information is more accessible, it made sense to make this post free.

I hope you enjoy it. I did what I could to make this as digestible & as short as possible.

-Left

Getting back to the topic of death and taxes

“And I heard a voice in the midst of the four beasts, and I looked and behold: a pale horse. And his name, that sat on him, was the IRS. And Hell followed with him.”

-Johnny Cash

Inside an aging population the relative number of deaths will grow.

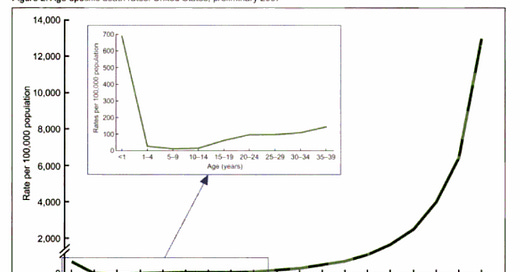

Incidence of death exhibits a non-linear change in probability as we age. If you make it past your first year of life, your chance of surviving until your 20’s is extremely high. It then begins to gradually climb from there and once the median age hits the late 50’s the chance of death starts to compound.

The mean, median, and mode vary amongst population groups and gender, but in general, they’re all clustered around the 70’s and 80’s. Thus, over a large enough sample size, deaths we can expect to occur into the future can be estimated with fairly robust accuracy. Deviations outside of this expected value is referred to as “excess deaths”, and health officials monitor these figures all the time.

The largest curveballs for such are things like pandemics (see COVID-19, which pulled forward some elderly deaths), or medical advancements which help us stave off the reaper for our old and young (improvements to infant mortality are the greatest source of improvements to the *average* lifespan in medical history).

As such, the following population trends displayed create a growth algorithm for the end market of funeral and cemetery services, in spite of declining funeral rates in favor of cremation (more on this later).

What I am trying to show you in these pictures is that there’s in effect a tidal wave of deaths coming down the pike as greater number of the population ages into their mid 60’s. For the last 2 decade in the US, the cohort of people aged 65 has compounded at 3.5%, which is more or less a double. This implies that the total sustained number of deaths in a given year is also going to double, and likely over a period of about 2 decades. And despite the excess mortality Covid-19 created, this hasn’t even gotten close to being true (yet).

In the 2023 movie “The Burial,” there was a scene in which the movies villain, Raymond Loewen, was on his yacht negotiating the sale of a business with the film’s protagonist. During the scene he smiles, exclaiming about the oncoming golden era of death that’s coming due to the baby boomers.

If you’re into movies surrounding the excitement of a court room drama, it’s worth a watch.

Unfortunately for Raymond Loewen, his death services empire never made it to the “Golden Era of Death” due to excessive amounts of leverage and a sizeable lawsuit. But here we are, nearly 30 years later, and the pipeline today is indeed fat. Sorry Ray.

The industry is not without its headwinds, but this is ultimately the forward driver of these companies.

Age demographic hedging of a long only portfolio

There’s an additional angle I want to discuss here. In my opinion there are not many businesses which you can comfortably say are going to be beneficiaries of an aging population. The issue revolves around aggregate consumption and the labor pool.

Outside of very specific types of spending (like healthcare), as we age spending generally begins to decline. The topics I found discussing this are a bit too academic for this blog, but needless to say the real causes of this aren’t the easiest to tease out.

The issue of the labor crunch is far simpler. Fewer people will be left to work to support ever growing amounts of infrastructure. With a demographic crunch on our hand this leaves a tighter labor market, inflating operating expenses via wage inflation. We’re lucky in the sense that people want to move to America, which will help stem some of the low natural birth rates. However, we already have a low unemployment rate. Which been more or less true for decades and the population aging by an additional 15 years over the next 30 isn’t going to help.

We’re certainly not in as tight of a spot as South Korea is, who’ve the scariest total fertility rate trend in the entire world.

No population in the world is aging faster, and without a dramatic change the median age of that country is rapidly and asymptotically approaching a rate of change of 1 year per year. If I owned a plumbing business in South Korea, I would be absolutely terrified about having any workers available in 20 years & would likely begin seeking a buyer.

In my mind this is all basically an unavoidable macro headwind towards the latter half of my life, when the rate of compounding is going to matter most in terms of its absolute dollar value impact. This isn’t an issue that governments are blind to. The “Do IT for Denmark” fertility campaigns have been going on for at least a decade. And yet…

This is the way the world ends

This is the way the world ends

This is the way the world ends

Not with a bang but a whimper.

-T. S. Eliot

So today I’ll be talking about a group of US companies in position to capitalize on the trend. These are:

Service Corporation International

Carriage Services, Inc.

I considered discussing Park Lawn but decided to leave it at these two and generally speaking, everything said here applies to them as well (it’s a predominantly US centric business that just happens to trade on the TSE).

The following topics will be explored (briefly) given following longer-term bets requires a much higher bar than observation that the next 3-5 years of cash flows are simply too cheap. A lot of these things require maintenance diligence, so while there’s a lot listed here, it’s not going to be too excessive.

Minority shareholder alignment

Overview of insider behavior

Corporate governance developments

M&A runway & organic growth profile

Pricing elasticity and trends

Upcoming changes to M&A capacity

Specific rules set in place 10 years ago are about to expire for SCI, making M&A easier.

Emergent products from foreign entities that may enter the US market.

New products have been coming out of Asian countries for death care services— the product development work here is preliminary but extraordinarily compelling and could represent a new vertical for death market care services to explore with an entirely different margin profile. It’s my view that this could be one of the major consumer products to come out of generative AI.

FTC risk

Recent developments and posturing by FTC - i.e., modernization of online advertising of prices.

In addition to this I briefly address some commentary on a short report for one of these companies that was put out about a year ago. I found parts of their analysis to be a little shaky due to some comparisons that were made that can’t be made in good faith.

Introduction

If it wasn’t clear, I’ll be sticking to the “funeral companies.” Not manufacturers of gravestones, caskets, urns, life insurance, or whatever other ancillary business units are attached to this industry.

There’s only one asterisk I have for this, and it surrounds an emerging product I discovered out of Anxian Yuan China Holdings Limited, a small funeral company in Hong Kong. It’s not a product I’ve seen anywhere else, but it does seem plausible that it’s a liable to be copied into other markets, deserving of careful regulation & it reportedly retails for the equivalent of about $7,000 USD today. It would also have a dramatically different margin profile than any other product within this industry, along with presenting one of the more powerful consumer applications of recent developments in AI we’ve all seen.

But what I’m going to start off with are the primary risk factors to these companies and industry headwinds before making any introduction.

Talking about the short report

Pricing wars eating into the operating leverage and crushing earnings was a chief complaint lobbied against SCI 0.00%↑ by a short report from last year. It’s on its surface, the most obviously valid criticism to these companies, and there are historical examples to show the devastating results pricing declines can have for this type of business. After all, these are quite levered businesses with high fixed costs.

However, the primary issue I find with the short report is the comparison it leans on.

Enter Dignity PLC

There was a great piece in the Financial Times that is free to read which describes what happened (to a point). The first challenge is determining whether there will be a similar dynamic at play in the US is found here.

The thread to pull is who Dignity’s competitor is.

Who is the “Co-operative Group”?

As the name suggests, it’s a Co-Op. Its primary business is as a consumer product retailer. A lot of food from what I gather. It’s the majority of their revenues and income. From what I can tell, they’ve never really pushed to make the funeral business a very profitable venture, especially considering the backdrop of what got Dignity PLC into trouble was their largest competitor initiating a pricing war.

That is the primary issue I have with short report. They compared the competitive dynamic of the UK where there’s this very large co-op that’s not really in the business of death for the business of death. This isn’t comparable to the US because there is no such co-op that can butt heads with the scale of SCI or even with the smaller operators.

Modernization of the funeral rule of 1984 - online pricing disclosures to drive pricing wars in funeral services and cremation?

This is actually something to watch. Dignity Memorial, which is SCI’s online platform that aggregates services within their network, has recently begun advertising prices of individual products online (link for example). I don’t know exactly when this started, but it’s fairly recent.

Fortunately, that means it’s not something that will sneak up on you (if you’re paying attention).

For those of you who may not be aware, the federal trade commission (FTC) regulates the funeral industry. Something called "The Funeral Rule” was developed in 1984 as an all-encompassing piece of regulation for the death care services. It’s meant to protect consumers from funeral directors, crematoriums, etc., from seeking to capitalize on a family’s grief for exorbitant gain by not being transparent with pricing. As a person that’s not a psychopath, I can’t exactly call this bad regulation.

As such, funeral providers have strict requirements for pricing disclosures when interacting with consumers and are regularly monitored by the FTC. It was meant to remove opacity from the industry. But inside the modern world where the internet has become the primary way people search for information, it was inevitable that the means for disclosure probably had to change beyond what you’re required to say over the phone.

The announcement

The good news is since SCI has already started doing this with Dignity Memorial, so if online pricing disclosures is actually going to have an effect, it’s being tested at this very moment. Further, growth inside the preneed backlog suggests this isn’t something that’s adversely affecting the part of the business you’d most expect to be impacted.

Should online advertising actually eat into sales and whipsaw these companies’ financial statements through pricing declines, I’d expect to see this begin to show up in the preneed backlog no later than year-end 2025. If you’re unfamiliar with what I mean by preneed, some people make arrangements for their death care services prior to their death. It’s an unfulfilled service obligation, so it’s recorded as deferred revenue.

On pricing, SCI has been able to roll through pricing at *marginally* higher rates than inflation. Not enough to make a tobacco investor smile, but enough to offset inflation.

Now my thoughts are these are the least stressed customers SCI is ever going to interact with. Hence the most likely to “shop around” or pick and choose where a funeral service is held. And perhaps I’m being overly American and upper class, but the idea of skimping out on a funeral service (if you’re going to hold one) just seems odd to me.

Now while I didn’t see online pricing disclosures on CSV’s end like I do with SCI, it’s probably not too much of a reach to abstract the results SCI feels from this to CSV. Of that same vein I feel okay with just writing out SCI’s pre-need backlog as a representative example.

Pre-need funeral & cemetery backlog for SCI

2023 - 14.84B

2022 - 13.74B

2021 - 13.6B

2020 - 12.69B

2019 - 11.99B

2018 - 11.09B

2017 - 10.66B

2016 - 9.95B

Composition of the backlog - these sums are funded in 2 separate ways. Trusts and insurance. In aggregate, a little over half of the funding comes from life insurance policies, with the remainder coming from customer receivables. For funerals specifically the weighting is closer to 70/30 (weighted towards life insurance policies)

A significant portion of these assets is held inside marketable securities. They’re growing at separate rates which, SCI measures over 5-year periods.

Onto the primary headwind everybody’s heard of…

Cremation as a growing percentage of total revenue mix.

A rising trend of cremations over burial has been going on for a very long time. It’s far cheaper than burial and ultimately less burdensome for a family. In more geographically constrained areas like Japan, and perhaps out of religious customs more than anything, cremation is basically that entire market.

As of 2023 for SCI, cremation was 61.3% of services, compared to 59.2% the year prior. This is listed under risk factors of SCI in their filings. For Carriage services, INC., these rates were at 59.0% and 57.7% for 2023 and 2022 respectively.

Just below the discussion of cremation is a mention of fixed costs. This harkens back to the risks of a pricing war developing from online advertising. And as such it’s these two primary issues the pose a risk to the equity. Should revenues precipitously decline and not return, earnings per share would suffer materially for both companies.

Minority shareholder alignment (analysis of corporate governance).

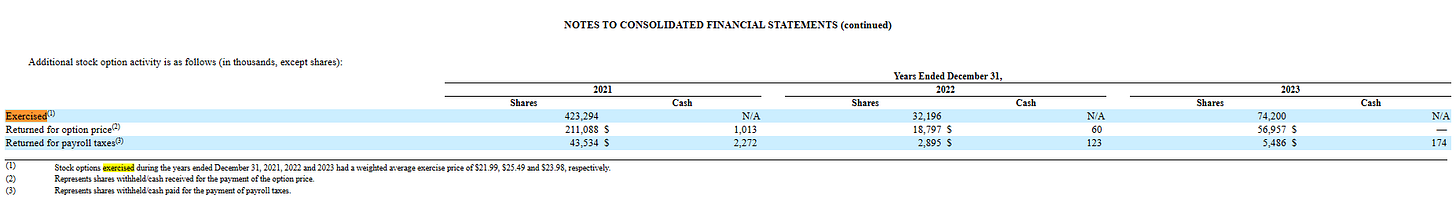

This is one dimension where SCI & CSV differ on substantially. The *recent historical* corporate governance of CSV appears substantially weaker with far less disciplined long term capital allocation and questionable insider behavior that looks to be motivated by employee incentives.

One of the reasons CSV has gotten into trouble lately was that when Covid pulled forward earnings, CSV leaned heavily into stock buybacks while carrying a historically elevated debt load. In essence they fell victim to the classic mistake amateur investors do with cyclicals at peak earnings.

If one looks deeper into the motivation behind these transactions, you’ll see that there was a lot of options held, and exercised by management at strikes where purchasing lots of stock assisted them in realizing that compensation. Unless remedied with changes to corporate governance, this is a black mark against CSV and is likely one of the reasons for the difference in multiples beyond simply carrying more debt.

Recent changes at CSV

CSV has been going through changes recently. This is all preliminary and a profile’s better suited after some working history, but here’s a list of the new team/roles filled.

In addition, an independent director “Somer Webb” and “Julie Sanders” was put onto the BoD as the chair of the board’s compensation committee.

It seems someone else took note about the ill-timed share repurchased that coincided with some nice stock options.

Capital Returns

Both companies pay a nominal dividend. Currently only SCI is retiring shares. CSV’s focus is currently on deleveraging their own balance sheet (for obvious reasons - CSV was at 4.8x net debt/EBITDA versus 3.5x for SCI). On balance CSV is the optically cheaper business and this deleveraging may result in a better IRR over a shorter period of time.

SCI has been far more consistent with share repurchases over a much longer period of time and has cumulatively retired a substantially greater percentage of shares (-51.74% reduction versus -14.42% over 20 years)

Capacity & runway for M&A (prior FTC involvement) & organic growth profile.

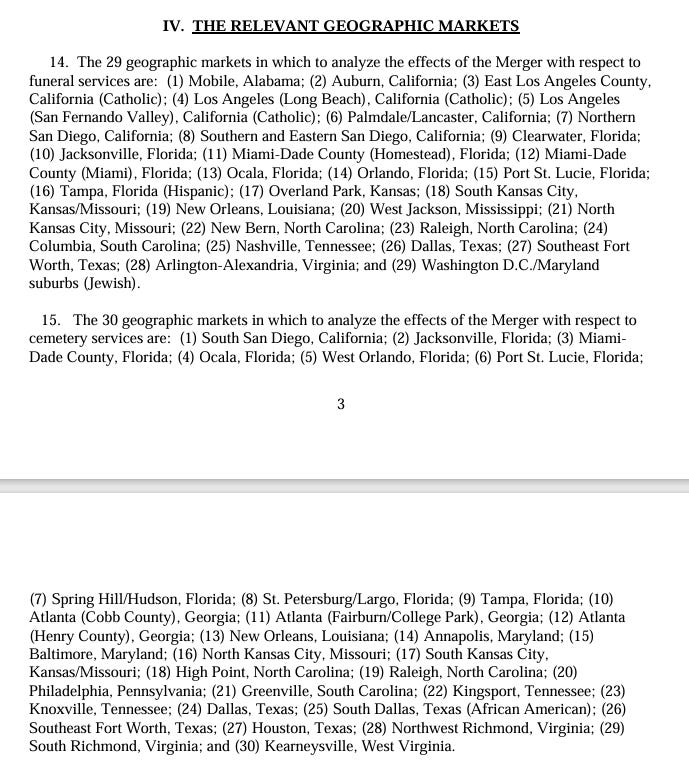

Something interesting is happening with SCI in terms of M&A capacity. Back to 2014 and with the acquisition of a funeral company Stewart enterprises, they were required for the next 10 years to clear any additional acquisition with the FTC in a large number of their primary markets. It was referred to as the standstill agreement and it expires in May.

From what I can tell, SCI doesn’t get into the number of markets where they’re gaining improved access to investor presentations or their conference calls. However, they’re listed in the FTC complaint document here.

What’s certain is their ability to perform M&A will improve somewhat. Some of these markets (like Texas and Florida) are some of SCI’s biggest markets. What the actual impact will be is hard to say without getting far more granular (and overall is not something that’s likely worth the effort), but overall, it’s certainly a positive development.

On CSV’s end, at least in the near term they really need to focus simply on debt paydown, and that kind of seems like their focus too.

Emergent products from foreign entities that may enter the US market.

Something interesting entered my sights not too long ago. The developments are still premature, and the scale of the product remains small. But in my opinion the tools to of form the first real next generation AI consumer facing products are now here.

Pair vocal cloning, the capacity to generate photo realistic video & images, LLM’s, a microphone, VR & a whole bunch of training data, and you can recreate a digital artifact of the dead that is capable of holding real time conversations as if you are standing in the same room as them. We’re a few product integrations and a haptic feedback suit away from being able to simulate the feeling of holding someone that’s dead.

I know some of you are likely recoiling in horror or disgust as you read this. But I also know some of you would pay almost anything for this. And the tools are here today, they’re just waiting to be packaged together.

A product like this would wield such an emotionally powerful influence over people that regulatory oversight of something like this would probably be necessary, which in theory could provide a requisite barrier to prevent extreme pricing declines.

And I’m not saying SCI or CSV will be the ones to implement these products, but it’s something to take note of.

Final note…

What the hell happened to the funeral companies in the late 1990’s, and can it happen again?

Something hit all of the American funeral companies in the late 1990’s. At first you might guess it was the dotcom bubble, but the declines were a bit too soon and it’s not like these are tech companies.

Remember our friend Ray from earlier?

Well, as it turns out, it’s kind of his fault.

The bankruptcy of the Loewen Group cast a dark shadow over the entire industry. An enormous lawsuit won against Loewen was the final straw, but their real undoing was their acquisition spree where they massively overleveraged their business by buying too many funeral homes and at too high of a price.

Their dramatic rise to fame created a mini sector specific bubble (in no short part due to SCI’s participation). To give you some context of the growth of the Loewen Group relative to its peers, that company was founded in 1985 versus SCI being formed in 1962. SCI had a 23-year head start, and SCI was still less than 3x the size.

So, when that bubble popped on top of a business model with high fixed costs and lots of debt, the entire sector got hit. Could this happen again? Yes, although it doesn’t seem like it’s as probable. The issue that could potentially crop up here was mentioned earlier with the modernization of the funeral rule to include pricing disclosures online. However, because this is something that can be monitored and is already deployed on Dignity Memorial (SCI’s online funeral/cemetery platform which aggregates nearly their entire business to an online search engine comparable to google maps), it’s not going to be something that sends the equity over a cliff without warning.

If it’s not obvious from the writing, I learn towards wanting to own SCI over CSV despite CSV being the cheaper stock. I own neither at this moment as in my shoes it just doesn’t make sense to quite yet.

Thanks for reading. Until next time.

-Left