A word of warning on a publicly traded business that I think is likely being mishandled by its owner/operator

Power REIT, Millennium Sustainable Ventures Corp, and Hudson Capital

Power REIT was a former cannabis growth microcap darling that lived in a niche market segment to much larger market counterparts like IIPR 0.00%↑. Its stock has had a stunning fall from grace in the last year - down 94.6% YTD. Investors may chalk this up to price, tenant risk, recent business developments (large assets have been held up), and in general the tenants of these greenhouses (marijuana wholesalers and tomato farms) will probably never make a dime.

It has yet to make distributions to shareholders common stock shielding net income under a prior NOL. This is on its surface a rational thing to do to allow for the growth of the asset base.

They made an entrance into cannabis greenhouse triple net leasing in 2019 and the results on paper for 2 years were spectacular.

I passed on this name in late 2019 - early 2020 when I heard the rent structure started with a short rent deferral period, followed by accelerated collections (of a ~36-month period), followed by steep step-downs in collections on the basis that rents would be lower for cannabis companies in the future. The other thing that gave me pause was there was significant involvement of related parties for assets held on the balance sheet of Power REIT. This is messy stuff to actually track for a company that’s signing 20-year triple net leases, so that all made it a lot easier to stomach missing a 10 bagger at the peak.

Checking back in on it I find the thing in shambles. What I found was this:

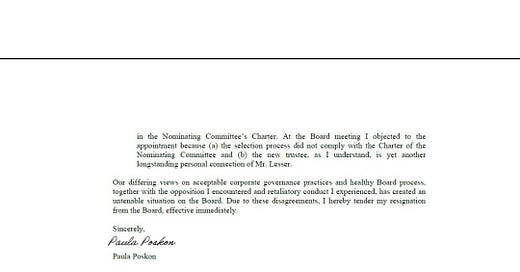

Former board member, Paula Poskon, was serving on the audit committee of Power REIT. The contents of this letter speak for itself.

oof! good call passing on it