Geo Group and Sygnity were products of last years work. I started to buy GEO 0.00%↑ around $7-8 USD/share and Sygnity for 40 PLN (unfortunately). These positions appeal to different types of investors, though both involve software. For brevity’s sake and usefulness of communication, this is a shorter post.

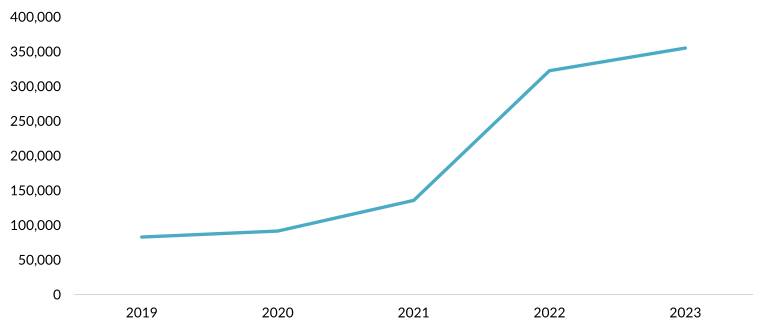

I’ll start with ICE ATD YTD data, the debt refinancing and what that might mean for capital returns.

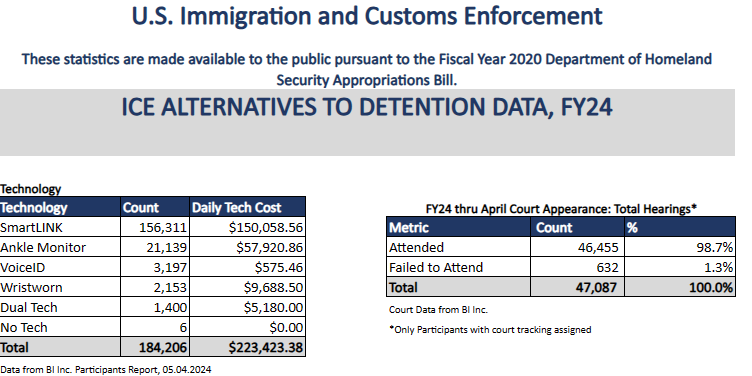

I’m not sure when it happened, but there’s been a funny change in how they label ATD participants in the ATD data.

Note how Ankle Monitor swapped out GPS on last years data.

Fewer enrollments, 2x as many ankle monitors, SmartLink down, expenses up.

On GEO’s side of the fence, revenues were down for the program by 34% Y/Y due to ISAP enrollment declining, so abstracting forward looking results from ICE’s ATD data (at least in the above format) is obviously a mistake.

The recent debt refinancing was favorable. It came with some dilution, but apparently some people were surprised to see this in the earnings report. Geo at one point had an enterprise value that eclipsed the market cap many times over, so deleveraging has been a positive catalyst for change in the valuation for over two years at this point. This refinancing was also a positive catalyst for more than one reasons. Some of the debt GEO group just extinguished had covenants attached to it that prevented capital returns. I don’t know what route they’re going to take when they reimplement them, but I imagine it’s just going to be a combination of dividends and buybacks.

All said, I have trouble recognizing what more there is to do. The funding for a substantial expansion of the ATD program has fallen by the wayside. Which is fine but it certainly dulls the edge of the pitch. My thoughts at this point are that GEO 0.00%↑ has so much tied up into these prisons that outside of debt paydown, what money that can get deployed into the stock should be, especially should a day ever come where a large transaction takes place.

To buy your own stock for $13 for a long time and then just happening to end up selling some real estate down the road where your NAV had you at $40/share 9 years ago, but now it’s $200 because the market puked the shares to you discounting the real estate into oblivion is a value investors dream. The market is so illiquid for these sites that I could never guess as to when a transaction could take place, and it might take years, but it’s something that may end up happening.

Despite lower ATD numbers, valuation of $1.79B seems fine given the company just did 85M USD of OCF for Q1. Debt paydown remains an obvious path for moderate forward returns (more than RFR but less than 10% without multiple expansion).

Sygnity

The global vertical market software aggregator baby has started walking the M&A walk.