A subsidiary of Geo Group Inc. has been supercharged by administrative changes & the border crisis while burgeoning construction costs have left real estate marked 80-90% below replacement costs.

Geo Group Inc.

Foreword: This is a topic that some of you might find distasteful. But this is not a blog about morality or ethics.

Disclosure: I am long shares of Geo Group Inc.

The Golden Goose - BI Inc.

Bi Inc. is the primary provider of technology supplementing the United States ISAP program (Intensive Supervision Appearance Program), and the Biden admin has caused somewhat of a boon to the number of illegal immigrants enrolled in alternate to detention programs.

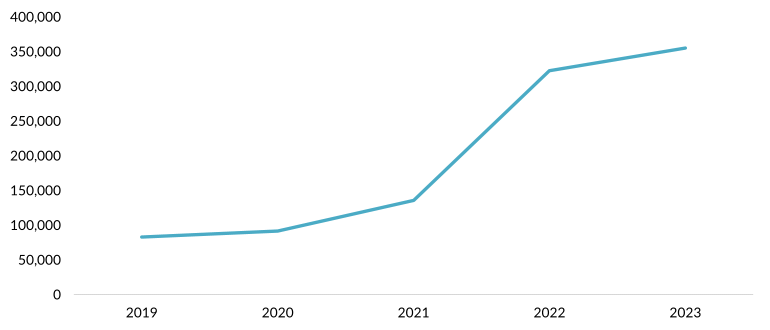

Pictured below - Enrollment in ISAP from 2019-2022 - Source

Note: This hit a local peak at the end of last year.

Current enrollment stands at roughly 194,000. Numbers are updated on this excel sheet every few weeks.

ATD enrollments as of 9/23/2023

Description of enrollment

“ICE exclusively determines the type of technology assigned to a participant, and not all participants enrolled in ISAP are on the same technology. The current, approximate breakdown is as follows:

92.7% of ISAP population utilizes a proprietary supervision application, BI SmartLINK® that is loaded on a secure device (BI Mobile) or downloaded onto a participant provided device. Approximately 60% of those using SmartLINK® access the app using their personal mobile device

1.9% of ISAP population is monitored with GPS tracking

4.3% of ISAP population is monitored via biometric voice verification.

1.1% of ISAP population is not on supervision technology.

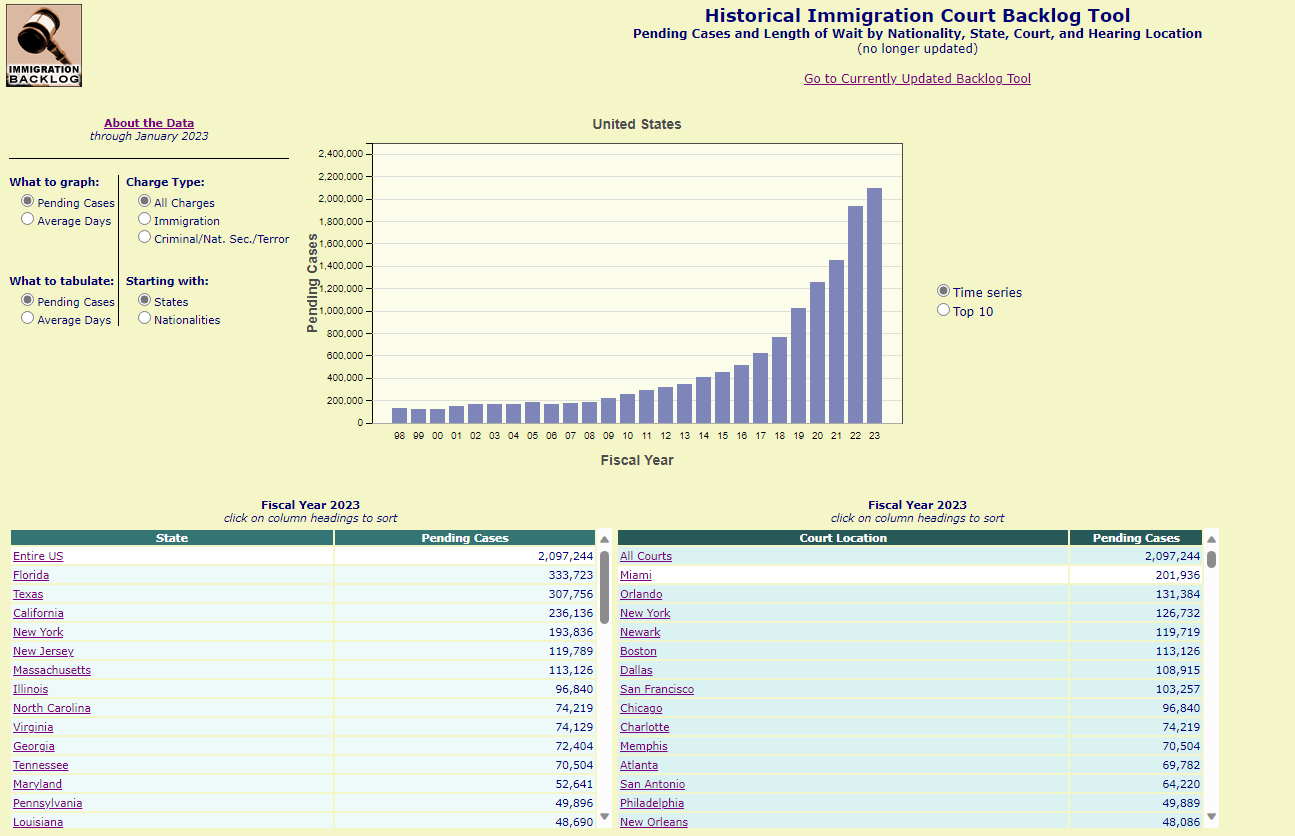

Enrollees then remain in the ATD program until they’re complete with the administrative process entailed. With the ongoing border crisis there’s a significant administrative backlog, having grown from under 200,000 to > 2,000,000 pending cases from 2008 to 2023.

This backlog is resulting in an increase to the LTV of ATD enrollments for Geo Group.

Catalyst #1 - The expansion of ATD

Something far more extreme than anything I’ve described is brewing in the backdrop.

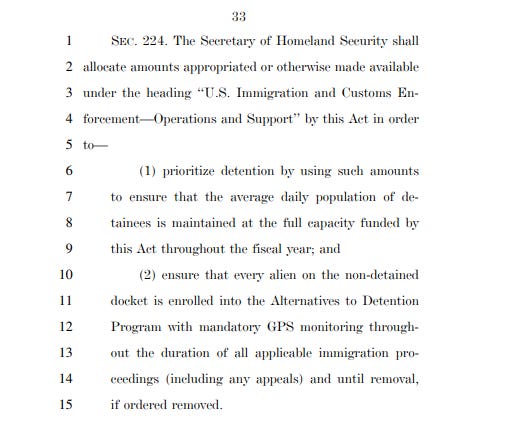

The house of representatives wrote the following in H. R. 4367

The non-detained docket is currently in excess of 2,000,000 individuals. To enforce this would obviously represent a dramatic escalation of the use of the alternative to detention program. And if you’ve a keen eye for details - you may recall that GPS monitoring is called out as mandatory for the entire docket - whereas current GPS numbers sit at less than 12,000.

To enroll an additional 1.8 million+ individuals into ATD would result in a *daily* budget of no less than 6.6 million, whereas it currently stands at $204,000. Now it’s important to note that the budget allocated to ATD (~$276 million) isn’t actually enough to fund this. So, it’s unclear as to whether the house is even cognizant of what they’ve stated here.

Bi Inc. by the numbers

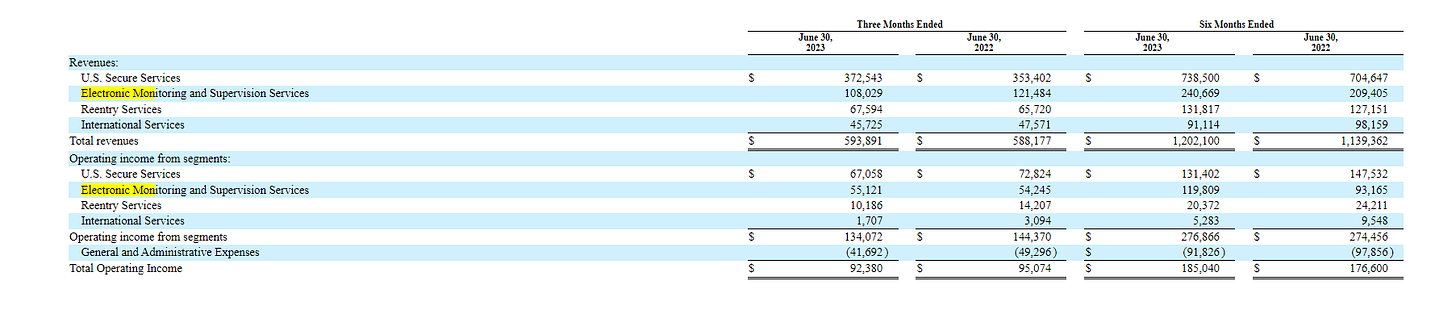

The electronic monitoring (EM) segment today stands is the defacto bread winner for Geo Group, and it’s the only segment earning above its cost of capital (more on that later). The difference in the operating segments is substantial, with operating margins of electronic monitoring reaching nearly 50% versus the prison and reentry services segments combined operating margin of 16%.

Should the government actually enforce what the house of representatives has laid out in H. R. 4367, $GEO’s net income margins would more than triple while their net income would increase at least 10x. This is very obviously not something that’s priced as likely to occur and it’s such an extreme outcome that I’m doubtful of it myself.

Catalyst #2 - Sale of assets which are marked 90% under replacement costs and 50% under market prices.

Currently Geo Group states they own $1,963,880,000 in property and equipment, primarily comprised of real estate under the U.S. secure services segment, i.e., the prisons.

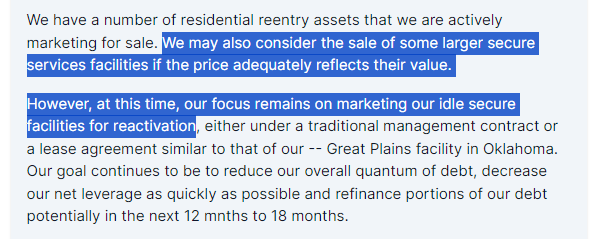

They own roughly 58,000 individual “beds”, the majority of which are for secure services. 8,982 of these beds for secure services are currently idled. It’s the company’s intention to reactivate them, however they’ve stated they’d be willing to sell the locations if they were to receive a ‘fair’ offer.

Source: Q2 2023 earnings transcript

Where are the marks at?

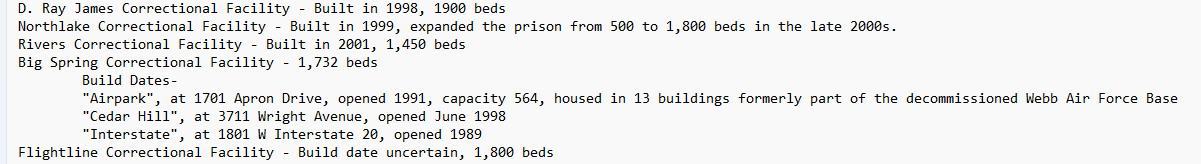

Currently the net carrying value of the idled facilities have the real estate assets for prisons marked at $25,712 USD/bed. These locations are roughly 20 years old.

The $ figure for the remainder of the correctional facilities isn’t dramatically different.

What about new construction?

Price on Alabama’s new 4,000-bed men’s prison rises above $1 billion ($250k USD/bed - estimated cost)

Will Nebraska need not one, but two new prisons at a cost of nearly $500 million? | Nebraska Examiner ($192k USD/bed, with roughly half of estimated costs going towards refurbishment)

Operating since 1869 (!!!)

Utah's new prison opens with much higher price tag than expected ($291k USD/bed - real cost)

Indiana’s Westville prison is state’s largest construction project at $1.2 billion ($285k USD/bed - estimated cost)

Stop The Chinatown Mega Jail ($2,555k USD/bed - estimated cost)

Sale of like-kind real estate

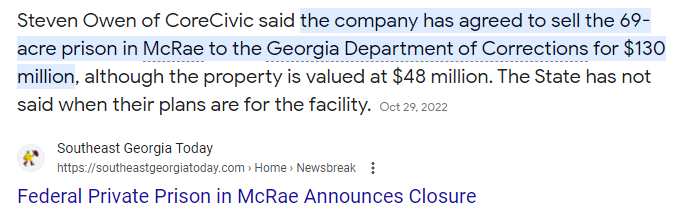

CoreCivic sells McRae prison to the state of Georgia for $130mm ($65k/bed), marked at $48mm according to tax documents.

Geo Group executes a Share and Unit Sale and Purchase Agreement ("SPA") for the sale of its equity investment interest in the government-owned Ravenhall Correctional Centre for $84 million in gross proceeds (> $300k USD/bed)

In my view, the real market value of these correctional facilities is so far removed from what is actually recorded on the balance sheet that it nukes their unlevered ROA into the low single digit figures. Well below their cost of debt which is sitting above 11%. So, if they can get anything north of 50-60k/bed, IMV, it would be prudent for Geo to be selling this real estate off. Especially the idled facilities.

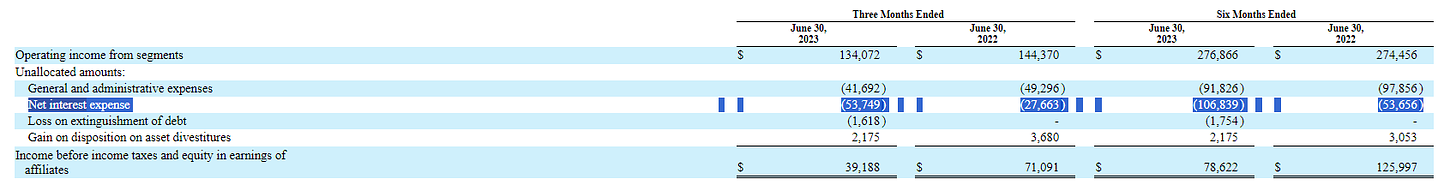

Conservative estimate of forward returns

What initially attracted me to Geo Group was the leverage. The market cap is currently just over a billion USD; however, the enterprise value is hovering around 2.8 billion USD. Further, the debt structure is a mess with high interest debt (>11% net interest expense) that’s occluding the earnings of the business. What happened was they ran into a maturity wall last year that was refinanced with significantly higher cost debt which has nearly doubled their yearly net interest expenses.

They’re currently aiming to reduce net debt by 175mm USD/year for the next two years. Assuming you get to exit at a constant EV this would imply shares trading 35% higher 2 years from now.

Source: Q2 2023 earnings call

Refinancing their net debt 200 bps lower (to 9.5%) add as much as ~30mm USD of additional net income per year & debt paydown resulting in 46mm USD.

Current 1.8b @ ~11.5% net interest expense

212mm

YE2025 1.45B USD net debt

166mm @ 11.5 % vs 137mm @ 9.5%

Should they continue to pay down debt, and especially should ATD grow, debt refinancing at lower interest rates should be in the cards.

Capital returns

For most of the last 10 years, Geo Group was a REIT. It became a C-Corp to help deleverage the balance sheet as mandatory distributions obviously hinder your ability to deleverage without dilution. As such, dividends have been paused since the beginning of 2021.

Covenants on their debt currently preclude any form of capital returns. The earliest dividends or share buybacks could resume is late 2024.

Until next time,

-Left