My grammar isn’t terrible, but it’s not good. I could never pay attention to it for long enough to master written English.

It’s easier than investing. And investing to a lot of people is measuring and judging the prospects of another language: accounting. And my reading comprehension is worse for accounting than English. To make up for my deficits, I often spend a long time with companies. And the majority of what you’re seeing out of me is a product of following products.

2022, I hear the name Cipher Pharmaceuticals for the first time. It stays in the backdrop until January of the next year in 2023, a few months after a private meeting I had in November. I begin to put the majority of my income into Cipher. It’s motivated out of the price of the enterprise to the cash flows from the product sales of Epuris.

What I find:

There’s nothing there to effectively dislodge a stranglehold (including Absorica LD)

the business is being discounted due to a perception of declining license revenues which that are rapidly being displaced by Epuris as a % of sales.

Management cut expenses to the bone and made the business a profit engine who started effectively returning capital.

So, I add, and I add, and I add for months.

During this period what happens is I realize I should probably know more about some of these licenses they have. So starting sometime around April of 2023, I begin to read more about Nail Fungus.

And then the significant issuer bid for $6M CAD of shares at a premium happens.

In this Cipher is required to do a valuation report. And how it’s more or less formed on the basis of internal expectations of management. And they have this pie in the sky attitude about themselves.

It really makes one hopeful.

But I didn’t want to just look at a picture but understand why they’re modeling free cash flow growth from 10M USD to 40M USD while tendering for 5% of shares.

What was Craig Mull thinking?

This left one thing (the real joy of small companies is their scope is small).

All of the projections that Cipher Pharmaceuticals gave its investors was a valuation report for the growth of an asset called MOB-015. So, I begin to monitor Moberg, and I pull the thread on the market for nail fungus.

What I find is a market in ruin.

Customers unhappy.

Physicians unhappy.

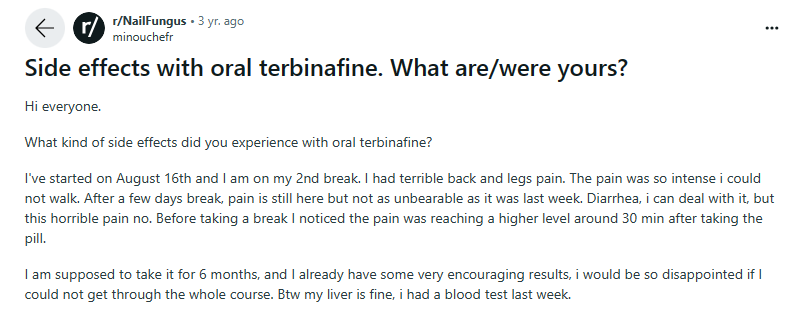

No one effectively treating outside those using oral terbinafine, topical volumes were and are anemic despite ample and numerous low-cost products.

Active patients are grinding their nails down in an attempt to make topicals more effective. Most give up.

A management that is despised, and strange guidance from the IP owner of MOB-015, Moberg Pharma, which eventually gets sold down to an enterprise of around 20M USD that needs to capitalize an additional $25M USD into R&D on a very small opex.

An end market that stretches the globe that’s nearly a billion strong.

Did you know that if could count a whole number out loud to a billion and say a number every 5 seconds until you reached a billion, you would be dead before you much more than halfway finished.

Try saying four-hundred-million, eight hundred & seventy-two thousand, nine-hundred and fifty-seven 10 times fast. A billion is a hard number to imagine. And it doesn’t fit into the equations or assumptions of many of the people are using to judge either of these equities. Now obviously Cipher can’t reach a billion people, but even inside their market it’s a large number. Somewhere between 2-6 million Canadians afflicted. Around half are treatable along with all other incremental infections, and we can get terbinafine into these new infections without side effects and cure it for >70% of infections.

These statements are not a reflection of scientific truth, but they are a public declaration. And it’s reflective of negative discourse on the market of available solutions.

The fungus is everywhere, including on U/Survector_Nectors head.

Appreciate all you put into your analysis and grammar/writing. You ride the roller coaster well. Maybe someday you will joggle on a roller coaster!