I have left Haypp alone on this blog mostly because there’s better work out there to find with

that’s free and I don’t have a lot to add. commented under a post about ClearPoint’s drug portfolio of all things asked for something on Haypp so I thought I’d write at least something.I want to lead with the last week. There’s a demonstration of a headline rocking shares lower that’s of the same color but not severity of the risk people really worry about for Haypp (online nicotine pouch prohibition).

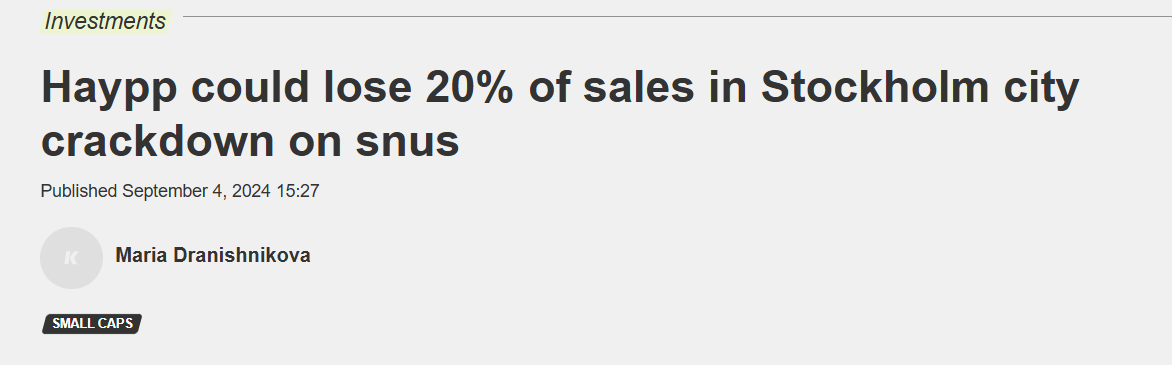

Haypp is a company that’s been around for a while but only started trading in 2021. Very bad timing for a listing of an unprofitable microcap. They have built themselves as a distributor of snus that grew into nicotine pouches with the shift in focus happening around 2018. The most recent market drama surrounding Haypp is about some recent news out of Sweden regarding their license to distribute Snus citing concerns over age verification.

20% is a big number, and the listing is Swedish origin so presumably most shareholders that aren’t insiders are Swedish and this is definitely something that would feel worse than it is living there. But worst of all, it became a “fintwit favorite,” which is supposedly predictive of future returns I am told. Truly a perfect storm to rock a high-flying microcap a bit lower. But the question is, even if this does all happen (Haypp is saying they’re perfectly willing to bend to age verification, which I think probably being born out of issue of rural settings H/T Jason Hirschman), does any of this even matter?

Remember, rule 1 is being broken already:

But what if something does happen?

Snus has been masking the growth of the company and is also shrinking to flat (guided flat last quarter). Which if you’re remotely up to speed on the business you should be aware of. To be clear, I’m not saying that loss of Snus wouldn’t impact the near-term financials or that its loss can’t make the shares go down. It definitely would for the former and probably would for the latter. I’m just of the opinion that if Snus is what people were paying for this stock would not be anywhere close to 90 sek.

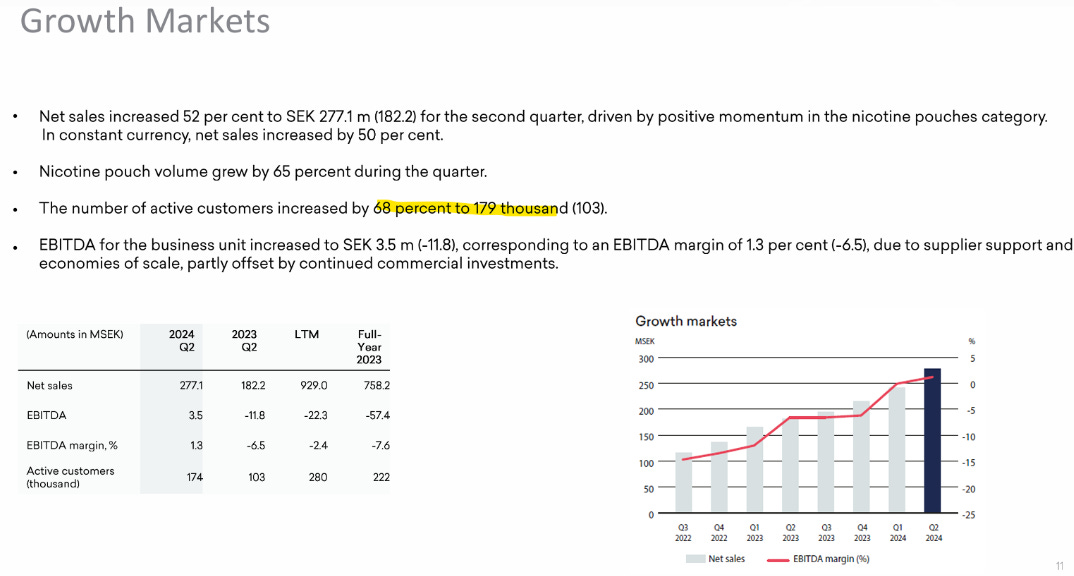

Now maybe I’m just crazy but when I look at the number of active customers within growth markets, the question I have is how this doesn’t end up growing to > 10x its current size short of a prohibition of nicotine pouches sold online. As a derivative of the main source of volumes for nicotine pouches, which is itself the newest and fastest growing nicotine CPG (newsflash I know), the online channel size clearly lags that of the category. It just recently benefited from the Zyn shortage in retail, and a lot of those customers if you just go by previous cohorts are liable to be sticking around.

The growth markets aren’t even just the US which might be a naive interpretation people make due to the market’s emphasis. These numbers are from the US, the UK, Germany, Austria and Switzerland. I say this as an investor with a Costco membership that understands nicotine addiction well: 179,000 (174? see table) active customers spread across 3 months in 8 countries may as well be rounded down to zero in terms of scale.

The point is there’s barely a soul ordering from Haypp and the rat trap of nicotine addiction and pricing advantages they enjoy seem incredibly well suited for durable growth in spite of there being no real switching cost for a consumer. This looks like a war of attrition with online distributors that Haypp is at least somewhat dominant in. The growth markets EBITDA margins are gradually being pulled higher with further scale, leaving you with the most expensive current sales of your company inflecting to positive margins (there’s little in the way of depreciation that represents ongoing capital expenditures). This will result in rapid forward distributable EPS growth. The pricing advantage they have over a distributor like Couche Tard can later be filled into to an extent. I.e., they have pricing power, but they don’t want to exercise it today because they’re maximizing for growth. Which is the sane thing to do if you’re thinking about 10 years from now versus next quarter or where the shares will trade next week.

I own shares in Haypp Group. I recommend watching the Capital markets day presentation when you have the time and to read

’s work.

Thanks for highlighting my work. As you know, you simply can't have a rapidly growing company, in a rapidly growing category, with rapid changes in competition and regulation, and not expect some alarming headlines. My views remain undeterred, and I will be sure to walk through some of the recent headlines in coming pieces.

Thanks for sharing this. Capital Markets Day presentation is really good