Revisiting Solar- a capital efficient nanocap in Europe situated in a growth market is trading at an extremely high forward FCF yield on their existing order back log.

A well-established playbook capitalizing on regulatory intermediation of renewable energy development.

The majority of my historical realized returns (both in terms of absolute dollar amounts and relative returns) after nearly 8 years of investing have come from a select few securities (in my case 3 compromise >95%). This is the natural fate of all stock picking and a part of why it’s hard— a few decisions will be the primary determinants of your long-term outcome. The days of Lynch are over.

One of these three positions for me was a solar company named Enphase Energy. I purchased the majority of my stake between the summer of 2018 and the spring of 2019 and was fortunate to have held onto that position until around $200 USD/share.

The features of Enphase which motivated the position were simple enough and I briefly discussed them with Brandon Beylo on his podcast.

But broad strokes, here were the motivations for the position and the eventual drivers of share price.

There had been incredibly large amounts of volume growth for solar for a very long time.

Enphase tied a relatively high margin component of the solar tech stack to panel volume at a ratio of 1:1, implying revenues would explode higher with growth in the end market for solar and or with incremental market share gains.

Topline margins had been expanding (gross margins went from ~20% to ~30% from 2017 to 2018. This margin expansion continued on for a couple more years, leading to their operating income margin increasing by >10x over the following years. This coupled with large amounts of revenue growth created an inevitable consequence for EPS and thus the share price.)

Strong technological competitive edges that benefited owners (in terms of production & thus their bottom line), installers (installation was quick and simple), and technicians (i.e., troubleshooting, and fault tolerance of the system).

Not all of these features of the business are shared by what I will be writing about today.

The business doesn’t have much of an opportunity to scale outside of microcap territory— it is a model that only works as a relatively small business.

There’s not a strong moat to protect from *local* entrants.

However, it does have several objectively superior qualities to Enphase.

The business is extremely capital light and will require little in the way of reinvestment to grow, meaning most of the money they earn can be returned to shareholders.

Their margins are absurdly high (at times reaching well above 50% net)

The business occupies a regional growth market that’s not as far along the penetration curve of other European countries. In addition to this, incremental installations are essentially being mandated by the European union. The incentives for deployment are large and will almost certainly remain in place for many years to come.

The primary rationale for selling out of Enphase when I did was motivated by this last point.

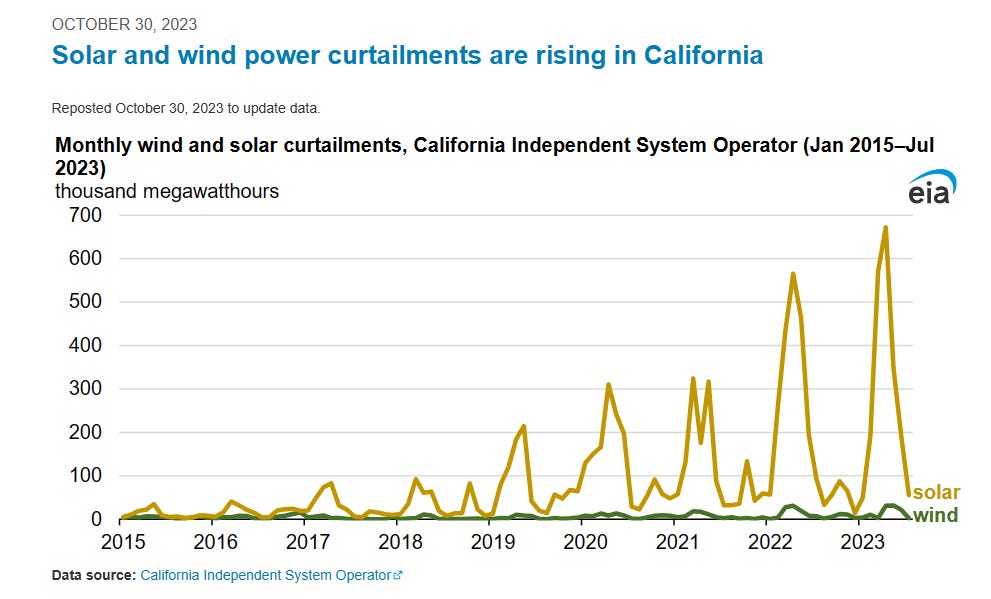

Because we cannot store large amounts of energy on the grid, solar has an integration problem where hypergrowth of installed PV slams into a wall of diminishing marginal utility (and thus the economics of incremental capacity which leads to a collapse in demand).

The growth curve for the market I will be covering is one of the least mature in Europe yet is one of the fastest growing end markets (in relative and absolute terms). In addition to this, the company isn’t tethered to solar— there’s intention to eventually expand into two other verticals.

Usually a business with these characteristics, even without an obvious moat, would command a pretty rich multiple. However, the existing valuation here is, in my view, rather compelling. The equity trades at a substantial discount to the expected value of the *existing* backlog, implying the shares may offer a high margin of safety at current prices.

Management also has a sizeable stake in the company, and they’ve intentions to soon begin distributing ~50% of their income via a dividend.

I believe at present the two primary risks the business faces are found within their current customer concentration, which has been dictated largely by a single (very large) customer and the countries willingness to approve new permits due to engineering challenges of integrating non dispatchable energy sources. A secondary risk is the price of electricity within the country (which is a primary economic incentive for new solar installations).

As it stands, the above appear to be the primary risks to execute & grow— I discuss these in more detail later in the post.

In addition to this, I provide links to two nearly identical businesses for you to study. The outcome over the last 2 years for these companies has been phenomenal with their average return being > 300%.

I’ve included a translation of a video interview with management from a few months ago that was without transcript or subtitles, so you will be the first non-native group to be able to listen to that. It’s by far the strongest piece of content inside this post.

This was first foray into solar since Enphase, so I had quite a bit of fun in the discovery process here. I hope you enjoy this as much as I did.