Business & Market Overview: Redishred Capital Corp

Pictured below: A paper baler

Pictured below: A line of PROSHRED SECURITY diesel trucks

Pictured below: A bin of shredded hard drives

Pictured below: Scanning paper into digital format

Proshred

Despite being seen as a bit of a melting ice cube for longer than I have been alive - paper isn’t dead.

Document sharing applications, laptops, cell phones, & tablets, as well as trends towards a WFH environment have significantly reduced archived paper volumes but paper still finds its way into offices all around the world.

This high tech versus low tech conflict exists everywhere. You might be able to think of some other examples yourself. My favorite at the moment is coal, which as recently as mid 2020 had been abandoned by almost the entirety of the investment community.

The lesson I’ve come to from these situations is displacing something that’s useful, simple & cheap with a higher tech solution is hard. If not an outright misapplication of technology.

The core function of Redishred Capital Corp’s operation exists under the “PROSHRED” trademark and franchise. That is secure, onsite disposal of sensitive information. If you’ve worked at a private or public entity that had strict internal controls over information security of physical documents, the benefits of on-site disposal should resonate with you.

Information security is a big business.

PROSHRED generates the bulk of the existing top line through scheduled and unscheduled services fees (in most part for shredding office paper), but it enables a number of other businesses. Namely document scanning & information management services, electronic waste disposal, and paper baling, which is sold as feedstock to other manufacturers.

Compliance

Federal & state compliance for entire swaths of our economy leads towards mandated document retention, destruction, and particular protocols when handling information.

Document Shredding On A Scheduled Basis | Proshred - YouTube

E.G., FACTA (or FACT act) is the Fair and Accurate Credit Transaction Act. This federal law is designed to reduce the risk of consumer fraud created by the improper disposal of consumer information. The FACTA Disposal Rule applies to every business and every person in the United States. But I didn’t need to know that in order to comply with whatever this woman had to say.

Systems sales & Competition

Total system sales are the sum of sales generated by franchisees (royalty payments), licensees and corporate locations. With the bulk of existing revenue coming from payments that are about $100 in size.

The #1 shredding company in the US is Iron Mountain. They’re focused on serving large businesses. #2 is Stericyle who acquired Shred-it for 2.3B USD of cash in 2015. #3 is Redishred. The difference in size between these businesses is large and there’s a long tail of extremely fragmented independents that own roughly 750m in annual sales.

Pricing power on service fees

Redishred should have pricing power over unscheduled and scheduled service fees because information destruction occupies a necessity and a low-cost solution.

You could have your employees do it themselves in a few instances. But when does it become a waste of time, or more importantly, a security hazard that could result in the loss of sensitive information about employees, customers, or the business? This isn’t an expenditure that’s weighing customer earnings down.

This comes together to result in an annual customer churn that is likely in line with the steady state rate of failure of business under contract (approximately 2% per annum - Sourced from devo791’s writeup on VIC).

Similar statements have been echoed throughout time and most recently in the quarterly earnings Q&A.

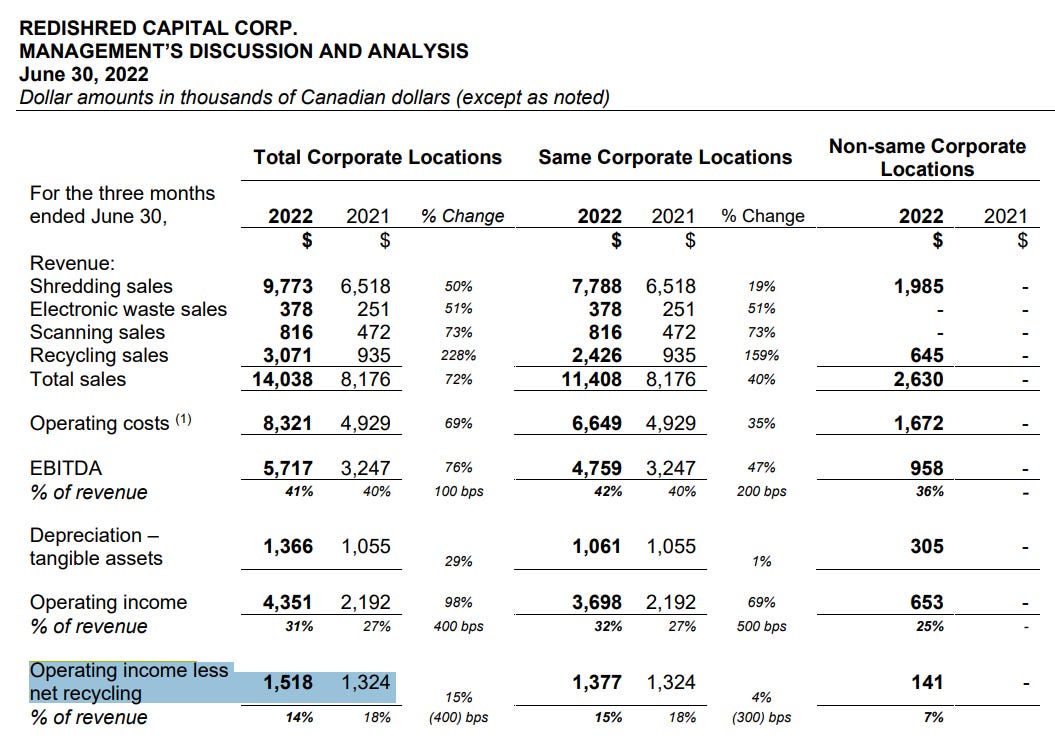

Q2 2022 -

Operating leverage

G&A as a percentage of revenue has gone from 41% in 2012, to 22% in 2018 & and to 10% in H1 2022.

The days of realizing 10-fold improvements to EBITDA margins are long gone for RediShred. Investors who were early to recognize these improvements have been appropriately rewarded with > 1,000% returns on their equity from purchases in-between 2009 - 2014. Although I do think a small amount of continued operating leverage may remain from continued growth in a national and regional scale.

Working Capital

Note taken from a recent interview with management:

Trucks comprise the bulk of existing assets on the balance sheet along with financing expenses. Leverage has been used conservatively since 2018 and roughly stands at 2.0x trailing EBITDA. Comps such as IRM 0.00%↑ are leveraged closer to about 5x EBITDA.

Growth - Organic

Redishred should have sustained organic sales growth for a long period of time so long as management keeps the business focused on growing regionally and nationally throughout the United States.

Their primary customers cover a pretty wide base of industries including finance & accounting, healthcare, industrial, schools, hotels & hospitality, government & public institutions, energy & utilities.

Seen below are the existing corporate locations.

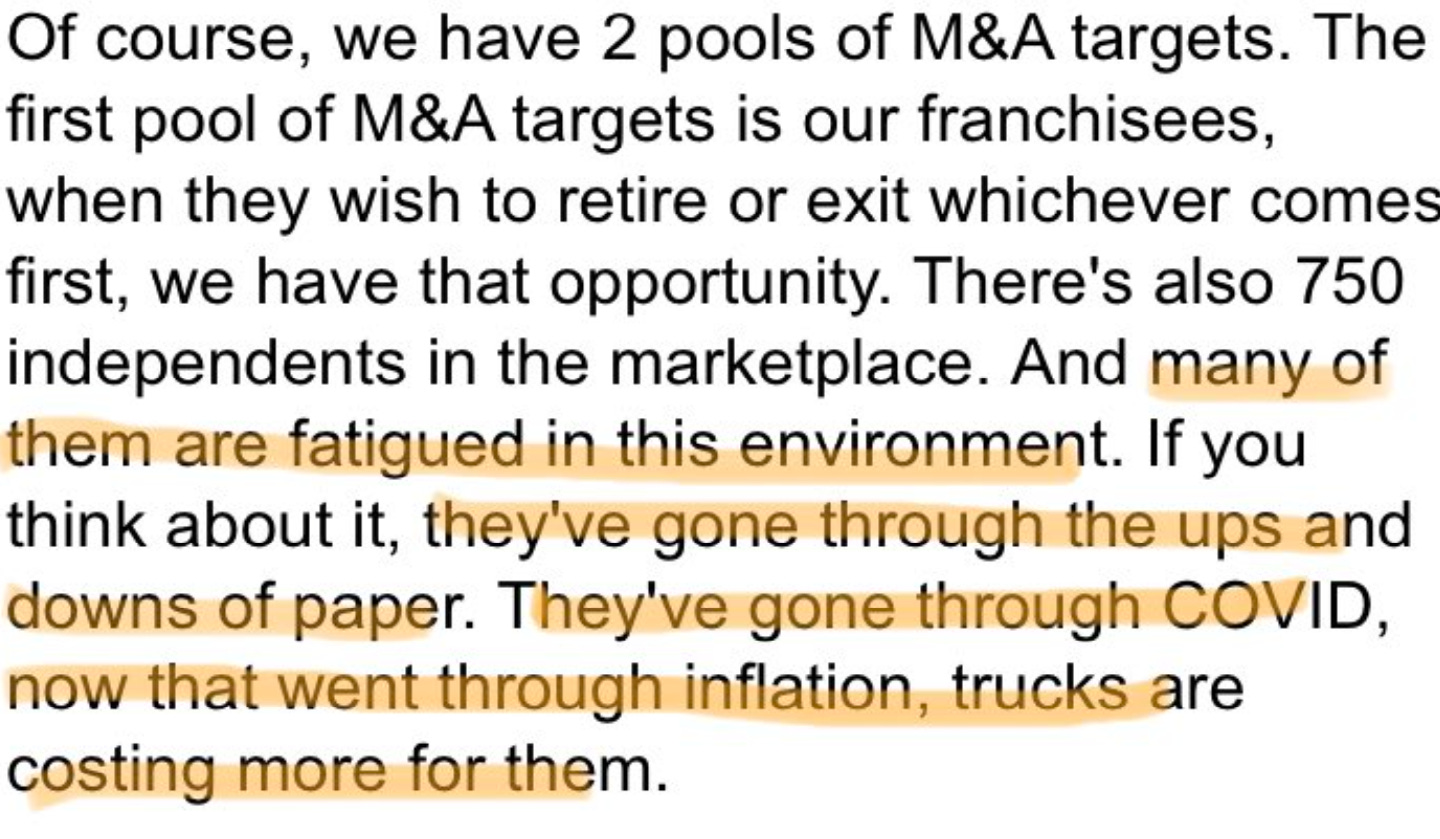

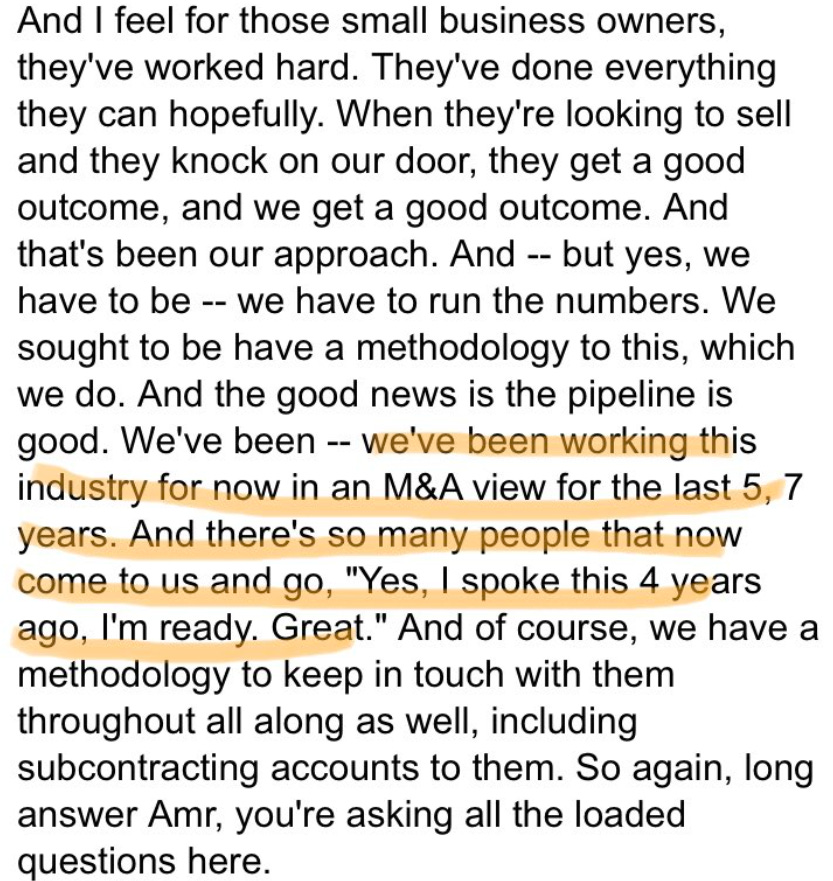

Growth - Inorganic

This is their pipeline of franchisees (16 as of Q2 2022) and stands as their M&A of choice.

The franchising business itself isn’t great for RediShred Capital Corp. There are some pretty large up-front costs and at scale they’re realizing single digit % royalty fees of a couple million in revenue at maturity. When these assets are owned internally, they contribute significantly more to earnings and free cash flow generation. And when people are ready to retire or sell the business there’s a clear end buyer. It’s not a pipeline that I expect to see grow tremendously, but it would be nice to see a new franchise added every few years to keep a healthy list going for natural M&A.

From the Q2 2022 earnings call

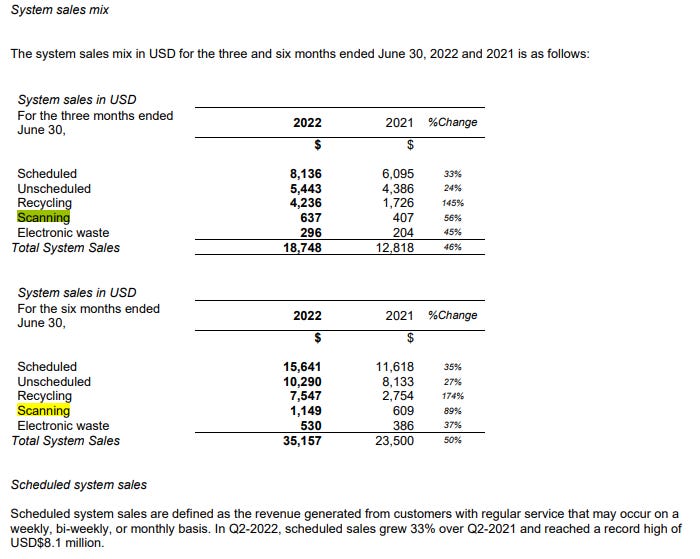

Upselling additional services

Under the umbrella of system sales there’s a few items which represent some forward opportunity for Redishred by selling additional services to clients. Most notably ‘document scanning’ is a recent development that’s done exceptionally well over the last 3 years of disclosures (introduced in 2020).

Often when a physical document is to be destroyed, a client will either request or require conversion to a digital format prior to destruction. I suspect the organic growth from this category may be quite good for some time as they upsell to existing clients. Pricing is a set fee per document.

In three years this segment has gone from roughly $30,000 CAD in 6 months to over $1mm CAD, so it warrants some attention despite it still being quite a small % of overall revenues. “PROSCAN” as it stands remains a key focus of Redishred Capital Corp.

Jeffrey Hasham and Moray Tawse

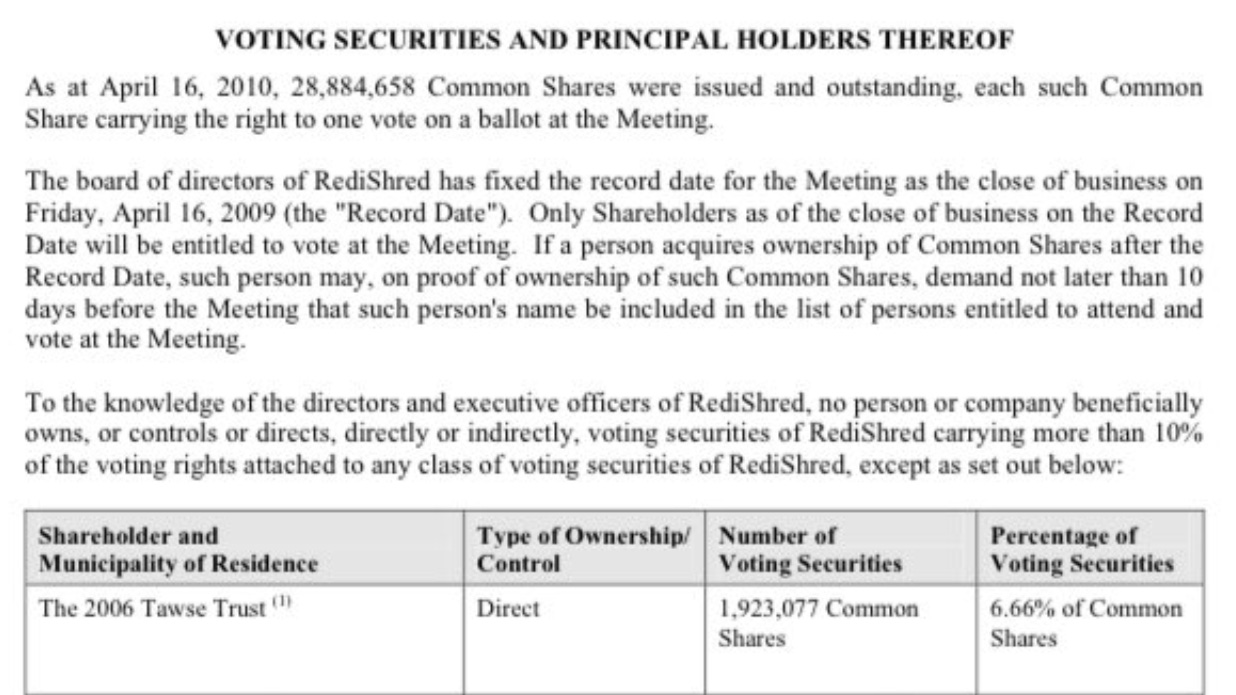

Ownership:

Moray Tawse is a billionaire created from Canada’s First National Financial Corp. He made the mistake of getting very rich by selling mortgages throughout Canada instead of buying and sitting on all of the real estate. He’s one of the longest standing shareholders with a position in the company since 2010.

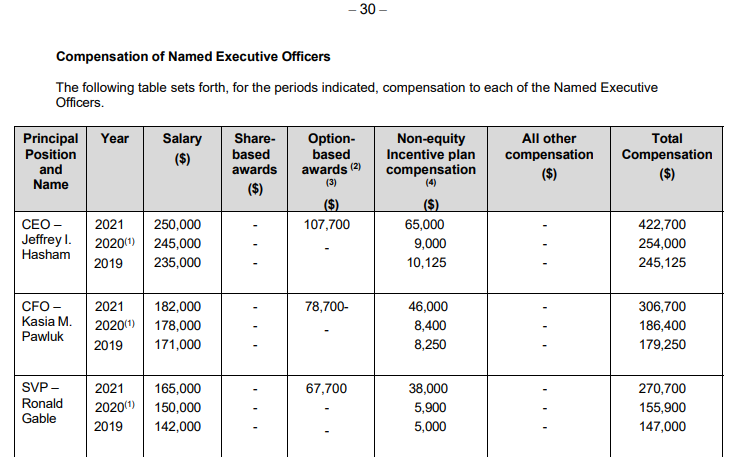

Jeffrey I. Hasham, Chief Executive Officer - Jeff has worked with the company in some capacity since 2005 & has been the acting CEO for over a decade. He’s continually taken part in secondary offerings when the company issued equity for M&A. By training he’s an accountant and CFO that eventually presumed the role of a CEO.

From the presentations I’ve seen by Jeffrey Hasham he seems both honest, intelligent, and to actually enjoy his work.

Executive salary, SBC, and shares outstanding

The fully diluted share count has been all over the place across the years as they’ve utilized market offerings for a long time to make acquisitions. However they’ve historically been accretive to shareholder value.

To date there are approximately 18,242,557 Common Shares, and 571,651 stock options are issued and outstanding.

Board Tenure

An inflation beneficiary

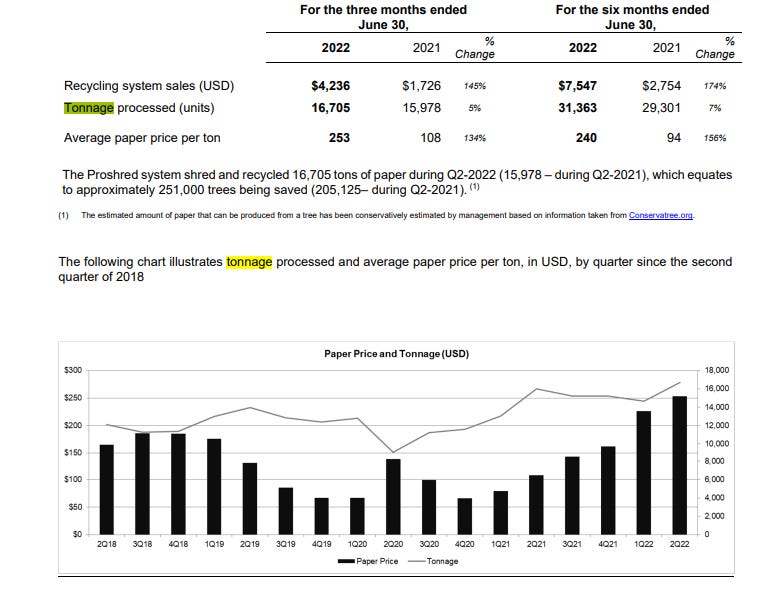

What initially drew me to $KUT.V wasn’t anything mentioned above (albeit I believe they’re more important characteristics for the makings of a long-term actionable investment), but rather them being a positive beneficiary of inflation in the price of shredded office paper (SOP).

You’re probably aware that at present day there’s an energy crisis underway in Europe.

This is a problem for paper manufacturing for a couple of reasons.

Making paper is a surprisingly energy intensive process. The industry in aggregate utilizes approximately 6% of global industrial energy usage. This is an astronomical figure, and it likely represents an unbearable change in input costs as fixed price power & gas contracts are renegotiated.

The fear David is alluding to is because of a key issue I will restate. As fixed price contracts for gas and electricity come to term manufacturers likely won’t be able to pass the input costs onto customers and will be undercut.

The process itself for a significant amount of paper manufacturing capacity in Europe is reliant upon the use of natural gas for heating. This equipment for the most part is not modular. It’s part of a large fixed industrial asset. E.g., see picture below.

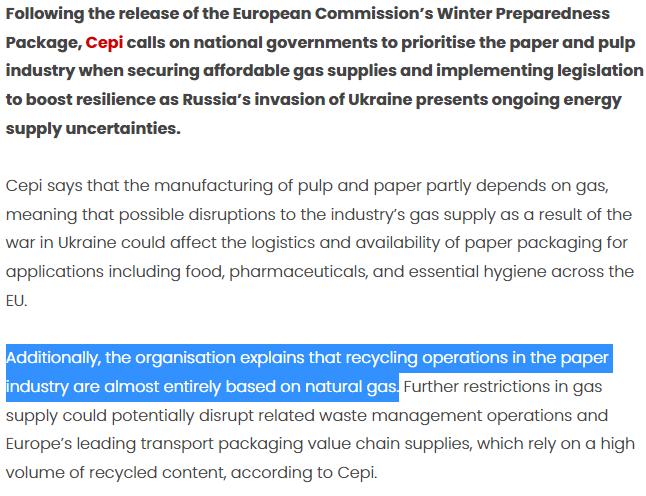

Commentary by CEPI

CEPI is the European association representing the paper industry. Here’s a screen grab pertaining to the ongoing energy crisis:

The follow up question is how much of the existing production in European paper manufacturing capacity is from recycled paper & the answer is it’s roughly 50% of all feedstock.

Globally Europe was roughly 1/4 of the worlds paper production & they operated as a net exporter to most of the world. Germany was the largest manufacturer by 3x, followed by Sweden.

But why is this important for Redishred? Because it’s a strong inflationary pressure that will help keep the price of sorted office paper high at a time when the recyled material market is collapsing

Tying it all together

If you take the difference between operating income and operating income net less recycling, and then divide and that by sales from recycling, you get a ~92% margin on operating income from recycling sales.

According to their disclosures this operating income is net of baling expenses which they perform themselves at 4 locations around the United States. Baling shred results in a premium, increasing total recycling sales/ton.

Now while sorted office paper prices are up and near all-time highs, the recent transient has only set them roughly 36% above Q3-2018 prices. Guessing what the normalized price point of paper is going to be is a fool’s errand & one I suspect most would get wrong. So long as tonnage processed continues to climb this segment should be perceived as a growing recycling business that occasionally getting extremely favorable pricing.

Q2 2022 - Zooming in on the short-term outlook

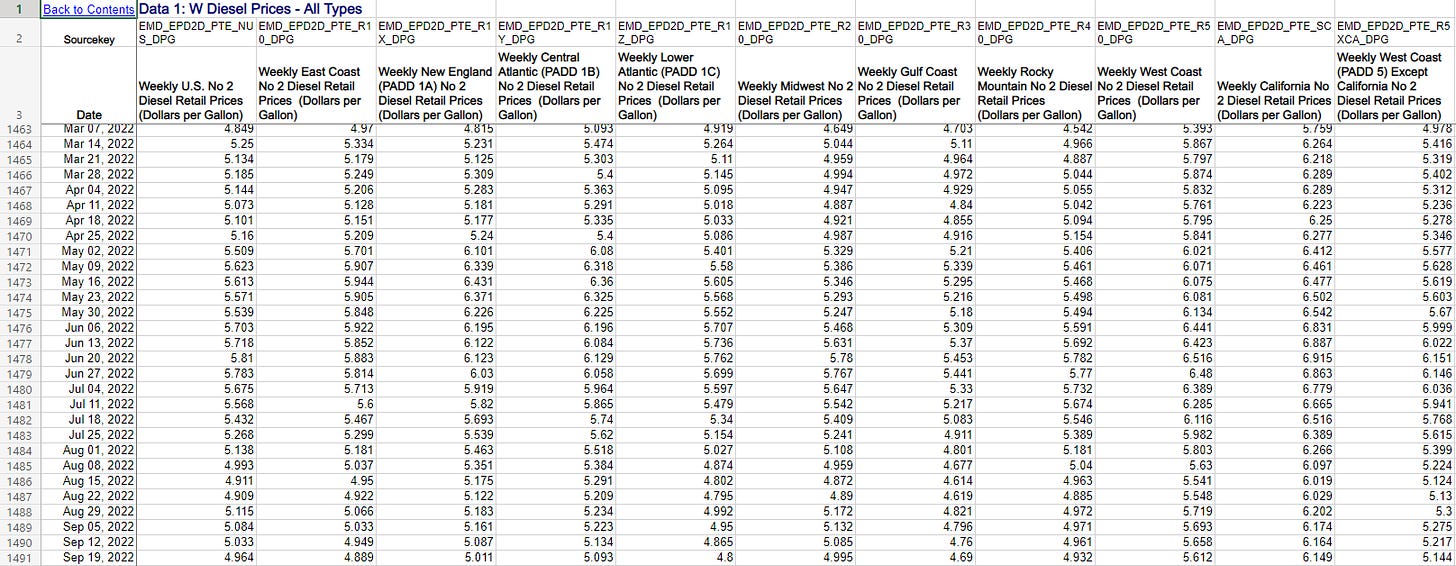

Diesel is large expense for the company, and it has eaten into much of the recent windfall that has come from the shredded paper boon. Diesel running up in price along with higher driver wages were the primary reason their Q2 operating income net of recycling sales had a 400bp decrease Y/Y.

But for Q3 - diesel prices have been coming across the US since June 20th.

And shredded office paper has been moving up.

July

Sorted office papers (PS 37) are up $10 per ton, now trading for about $230 per ton, compared with an average $141 one year ago.

September

The only good fiber news was in sorted office papers (PS 37), which remain steady at $241 per ton this month, compared with an average $164 one year ago.

October

Sorted office papers (PS 37) remain steady, at $241 per ton, compared to an average $165 one year ago

A return to normal?

If you back out all sales from recycling, for Q2 you’re left with a bit more than $1.5mm CAD in operating income. Interest expenses for the quarter were a bit over $400,000 CAD. Taxes of slightly less than $700,000 CAD. We’re left with a company with a trailing PE in the low hundreds with Q2 annualized. This isn’t exactly ideal but underwriting recycling sales to zero is an overly aggressive way of establishing if there’s any margin of safety without favorable recycling prices.

Closing remarks

There was a lot of information here. Any more risks insufficient brevity or a fatigued reader and exceeding the scope of my intentions in writing this.

I have a beneficial position in $KUT.V stock. Despite well intentioned effort, information written here is not a guarantee of accuracy.