Pro-Dex Inc.

A specialty contract manufacturer in medical devices with a burgeoning order backlog

As a thank you for the recent outcry of support, I’m going to leave this post without a paywall.

Today we’re going to drill down into Pro-dex Inc.

Price: $19.35 USD

Shares Out (fully diluted): 3.54M

Market Cap: $68.64M

Net Debt: $9.03M

TEV: $77.67M

Business description

Production of surgical implantable devices (screws, fixation systems), devices with electronics, custom software development, complex assemblies and sub-assemblies, sterilization, complex materials, and injection molding.

“Pro-Dex specializes in the design, development and manufacture of autoclavable, battery-powered and electric, multi-function surgical drivers and shavers used primarily in the orthopedic, thoracic, and maxocranial facial markets. Pro-dex has patented adaptive torque-limiting software and proprietary sealing solutions which appeals to their customers, primarily medical device distributors. They also manufacture and sell rotary air motors to a wide range of industries.”

Alignment

One of the more important things (in general) with these “mickey mouse stocks” (a phrase describing nanocaps/microcaps given to me by a friend which I absolutely adore) is to see if management is actually exhibiting behavior that shows they have alignment with the interests of minority shareholders.

To this end

Since 2018, the company has repurchased roughly 812,000 shares. As of the last date of filing, there was 3.54M weighted-average common shares outstanding, so the quantity of shares repurchased over this period has been material.

Since the initiation of share buyback program, the company reports the following:

“On a cumulative basis since 2013, we have repurchased a total of 1,197,168 shares under the share repurchase programs at an aggregate cost, inclusive of fees, of $17.2 million.” This comes to an average price paid of $14.36 USD/share.

In addition to this, insider ownership currently stands at 32.53% of shares outstanding so they certainly want the share price to go up.

I’m going to preface all of this with some additional information that is a yellow flag and or red flag/black flag (depending on your tolerance to microcap shenanigans. Microcaps seldom have strong corporate governance.)

To begin -

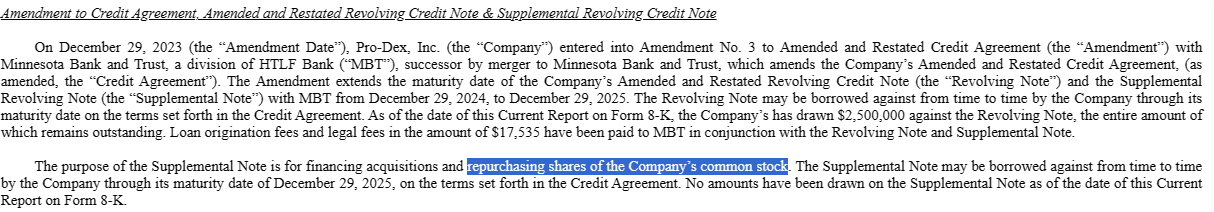

Let’s start here. This was in an 8-k filed last week.

If you’re unable to read the text on the image, what it says is they’re intending to utilize debt for acquisitions & share buybacks. This is very aggressive behavior for a microcap that’s a borderline nanocap. This is a ‘yellow flag.’ It is also consistent with the next point.

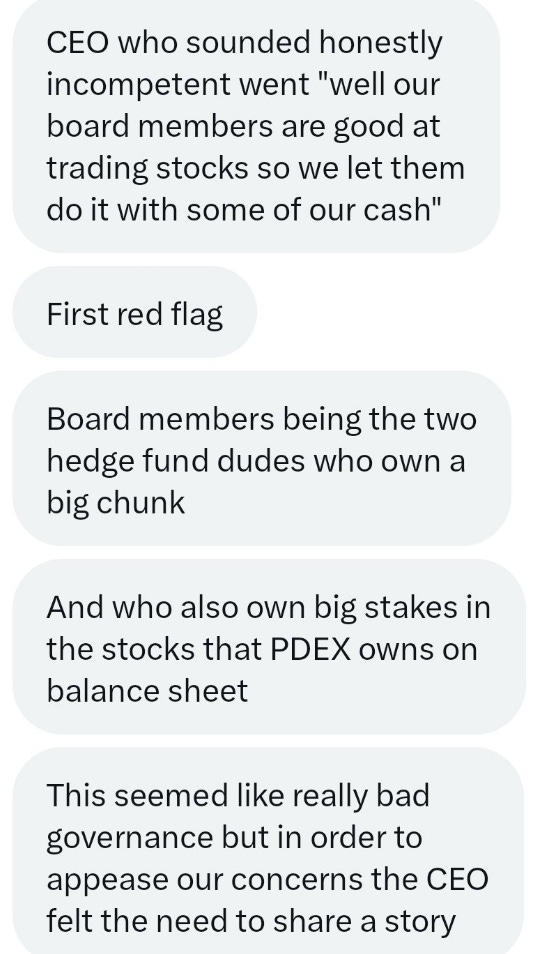

The red flag/black flag has to do with some prior behavior with investments the company has made and currently holds on the company’s balance sheet. I’ll start off with a conversation I had with an individual who interviewed management several years ago.

For a lot of people this quite understandably is going to be a deal breaker.

But it’s also consistent with the aggressive behavior that would lead a company like this to use leverage to perform capital returns. And there’s no trait I quite appreciate more than consistency.

Float

In rare fashion for a borderline nanocap, there is a fair amount of institutional ownership in both passive and active funds who cumulatively hold 25.25% of shares. I believe this relates to its listing on NASDAQ and that it has been a profitable company for a number of years.

Between managements ownership and this, there’s approximately 1.5M shares left to trade between retail, or slightly less than $30M USD.

The catalyst

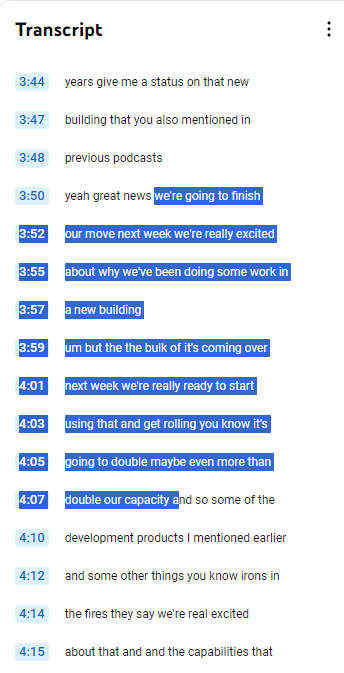

Pro-Dex has been internally expanding their manufacturing capacity for a few years now and it’s finally beginning to translate to additional sales. From this interview with management, their Franklin property is going to expand their capacity by at least 2x. And conveniently enough, this is roughly consistent with the relative growth we’ve observed in their backlog.

From the 2023 10-K

“Additionally, we continue to invest in property and equipment as well as personnel to expand our capacity to achieve higher sales volumes. To that end, we purchased the Franklin Property in November 2020. This building is located approximately four miles from our Irvine, California headquarters and was acquired to provide us additional capacity for our expected continued future growth. We began operations in the new facility during the fourth quarter of fiscal 2023. We believe that the efforts we completed to bring the facility operational will allow us ample capacity to increase revenues significantly in future years.”

“On June 30, 2023, we had a backlog of $41.6 million compared with a backlog of $16.5 million on June 30, 2022.”

This is the largest the backlog has been in at least the last 5 years and is likely the largest it has been in the company’s history.

RISK - customer concentration

Customer concentration is a double-edged sword. It usually results in a discount which can in turn amplify returns should the customer continue to increase the size of their orders, or the customer base simply growing more diverse (thereby lowering risk & multiple expansion).

Customer concentration has been the historical norm for Pro-Dex Inc, which I’m not exactly expecting to change. I believe this has to do with their niche in contract manufacturing, resulting in a few big customers dominating their financial statements. Below I provide context from some of their last filings along with information from a filing in 2008.

“In fiscal 2023, our top three customers accounted for 92% of our sales compared to 88% in fiscal 2022. In fiscal 2023, we had one customer, included in both medical device and repairs revenue above, that accounted for 67% of sales with our next largest customer accounting for 16% of sales. This compares to fiscal 2022, when these same two customers accounted for 66% and 14%, respectively, of our total sales.”

Given their backlog expanded sequentially from $18.8 millions to $41.6 million, the simplest answer to what’s happened here is their largest customers have essentially matched their orders to Pro-Dex’s expanded manufacturing capacity.

The question shareholders are now left with is whether or not this elevated quantity of orders is essentially a stepwise function where forward sales can be expected to remain elevated.

The balance sheet shenanigans

Okay, now returning to management being crazy.

Remember how the company’s management previously gambled on stocks to meet payroll? Well, investments are still being held on their balance sheet, and because they’re publicly traded instruments, they’re having quarter to quarter impacts on the income statement that need to be adjusted for. The impact these things are having is actually fairly material if the underlying moves more than 15%, so I would avoid looking at their earnings multiple to make judgements on Pro-Dex’s operational health to their actual business.

The exposure is to two separate companies: common stock of Air T. Inc & Monogram Orthopaedics Inc, which Pro-Dex recently received through exercise of warrants.

The exposure as of September 30th was $1,010,000 USD to Air T stock and $4,746,053 of Monogram Orthopaedics stock. Investments at September 30, 2023 had an aggregate cost basis of $2,714,000.

Since then, Air T is down 27% & Monogram is up 27%, so they’re going to report a gain on investment come next quarter, baring nothing changes too much in the next month.

Now, what exactly are these things?

Air T is an aviation company which deals with commercial “jet engines and parts, ground equipment sales, and overnight air cargo.” They’re also investing in other companies via equity, but we don’t need to go that far down the rabbit hole.

Monogram Orthopaedics Inc. is a relatively new medical robotics company which specializes in orthopedic joint replacement. They’ve just entered human clinical trials, so while the company has an operational product, the company is still essentially pre-revenue. The company did sell their first unit last November to a '“robotics distributor.”

Again, I’m not going to go very far into depth here, as I simply wanted to point out what these instruments are, but if you’re to look at the balance sheet and cash flow statement of Monogram along with where they’re at in their products life cycle (pre-launch & just entering human clinical trials), it appears that they’re going to need additional financing.

Not exactly ideal, but if the equity somehow survives the oncoming dilution maybe it will turn into something meaningful. It does look like a compelling product, but unless Pro-Dex sells out of their position, I would just consider the monogram stake a zero for now.

Conclusion

In my view, there’s not exactly a ton more ground to cover.

It’s my impression at this time that there’s not exactly a highly divergent view to be made here, versus something like Treosulfan which I described in my Medexus writeup.

I know I didn’t go very in-depth into their products, but the situation seems fairly straightforward.

This is a small, profitable microcap that’s looking down the barrel of a sizeable amount of growth in the short term, with roughly a 10-year history of capital returns and some iffy corporate governance as it relates to the handling of cash being invested into separate entities.

I’ll leave you with some additional information provided to me by a friend as it related to their product.

Until next time,

-Left

I do not hold a position with the issuer such as employment, directorship, or consultancy.

I hold a material investment in the issuer's securities.

An additional point, PDEX does not provide guidance but the CEO salary was increased by 15% this December 29 to 350K. First increase since 2020. And while he earned a 70K bonus in 2023/2022, this was now revised and they anticipate a bonus in the range of $75 to $300K as ‘one or more of the performance metrics and/or business targets are likely to be achieved in Fiscal 2024. We should have pretty good results with the backlog conversion…

Monogram is an interesting story. PDEX loaned them 1 million or 900 000 a few years ago and wrote it off. However, Monogram was able to repay them in full and gave them a warrant for 5% of the company at the end of 2018., This became valuable when Monogram ipoed in June I would bet that they sold some shares after exercising the warrant in October , otherwise why exercise it for $ 1 250 000 ?

I understand that PDEX is Monogram supplier for its driver which might have been the first reason for this investment.