I spent a long time writing about one of Sweden’s most interesting public companies. So, I thought I’d take a look at some of the portfolio companies of Industrifonden as that things being run by the co-founder of the most interesting public company in Sweden.

There’s an interesting hodgepodge of different early-stage products in there, and there’s some tie-in with interests of this blog.

To begin- a company I’ve written a fair amount about on the blog and elsewhere is ClearPoint Neuro. Asklepios BioPharmaceutical, Inc., a subsidiary of Bayer, has invested a tremendous amount of money into creating the manufacturing capacity to support some of the partners that feed into some of the oncoming wave of gene and cell therapies.

“New $500 million gene therapy manufacturing facility in North Carolina further validates AskBio’s groundbreaking AAV gene therapy accomplishments

Research Triangle Park, N.C. (Aug. 22, 2019) – In 1978, when a doctoral student named Jude Samulski started a journey of discovery for how the adeno-associated virus (AAV) could be used to safely deliver corrected genes to cells with genetic defects, the idea that one of the world’s largest pharmaceutical companies would build its gene therapy research program on his work never crossed his mind.

And that’s exactly what happened.

On August 21, 2019, Pfizer announced a $500 million investment in a state-of-the-art gene therapy manufacturing facility that is based on Dr. Samulski’s and AskBio’s AAV technology discoveries. The facility, not even an hour’s drive from Dr. Samulski and AskBio, the company he co-founded, further validates AskBio’s AAV technology leadership as well as the Research Triangle region’s status as a world-leading center for gene therapy research and development.”

October 10th, 2023

Bayer invests 250 million USD in new cell therapy manufacturing facility in the U.S.

New plant will supply cell therapy products for late-stage clinical trials and future product launches / Supports clinical studies with BlueRock Therapeutics’ investigational cell therapy for Parkinson’s Disease bemdaneprocel (BRT-DA01) / New facility located in Berkeley, California, USA

Berlin, October 10, 2023 – Bayer AG has opened a new cell therapy production plant in Berkeley, California, USA, to bring cell therapies to patients on a global scale. The USD 250 million investment will support the production of material required for clinical trials and potential commercial launch of BlueRock Therapeutics’ bemdaneprocel (BRT-DA01), an investigational cell therapy currently in evaluation for treating Parkinson’s Disease. BlueRock Therapeutics LP is a clinical stage cell therapy company and wholly owned, independently operated subsidiary of Bayer AG. The new facility will also support the future production of additional cell therapies as Bayer’s cell therapy portfolio advances.

“This new facility ensures our investment in cell therapies can become a reality for patients around the world,” said Stefan Oelrich, member of the Board of Management of Bayer AG and President of the company’s Pharmaceuticals Division. “Cell therapies represent an important opportunity to treat diseases differently by targeting the underlying cause or enabling the human body to restore vital functions.”

The new cell therapy facility is part of a transformation at the company’s dedicated biotechnology site in Berkeley, California, where Bayer has invested around USD 500 million over the past five years.

BRT-DA01, if unfamiliar, is a product inside ClearPoint. It will be co-labeled onto their devices should it clear the bar. But that’s beside the point— the point is that these facilities which are manufacturing cell and gene therapies typically cost a shit load of money, like a lot.

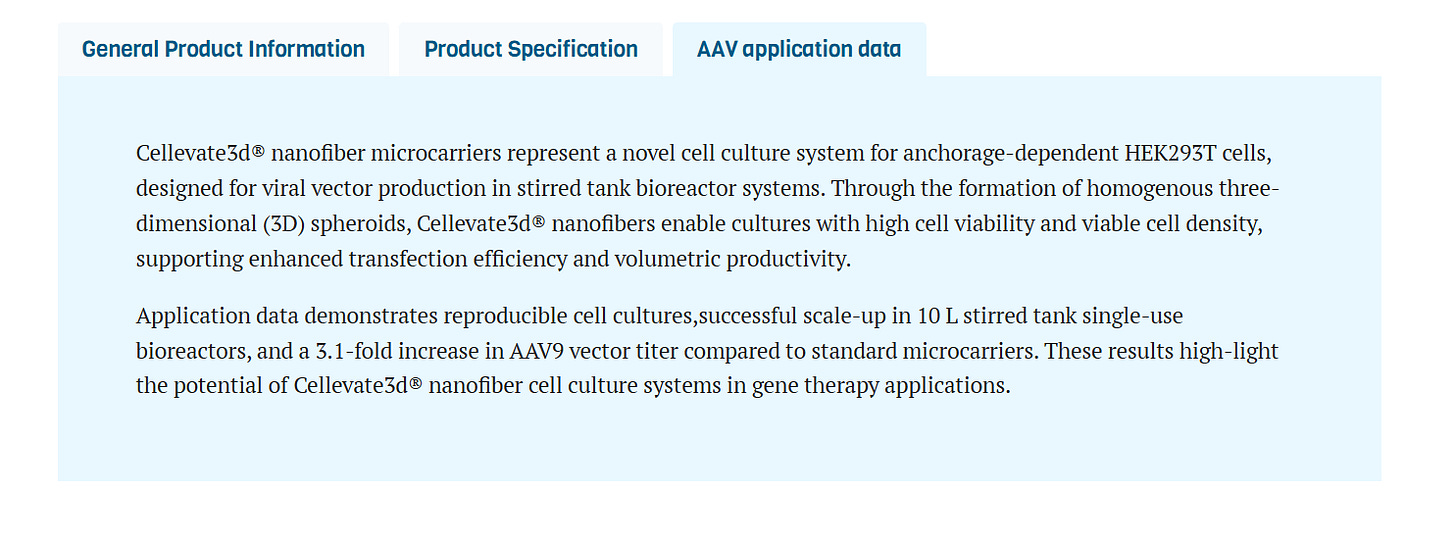

One of Industrifondens portfolio companies is called Cellevate. They use these nanofibers to make scaffolding for cell culture beds which purportedly have this much higher density in production which is invariably going to result in lower costs to production. What it looks like they’ve done is create these structures that helps maximize the utilization oof a 3d space. For someone like Bayer who’s spending billions of dollars to just get manufacturing up and going for all of these new therapies, getting something like Cellevate in a much larger bioprocessing reactor would do absolute wonders.

Stepwise improvements to cell manufacturing in bioprocessing facilities could probably help quite a lot. Bayer is probably salivating over access to something like that because it could potentially save them hundreds of millions of dollars by way of reducing future capex requirements to support this emergent field of gene and cell therapies.

The next one is Novatron Fusion Group. I don’t have much to say much about this because fusion is way over my head, but I was a reactor operator, so I know a tiny amount to at least make an analogy. They say they’ve made important headway on elements of plasma containment. To make comparison to the differences between fission and fusion— If you’re not aware, the horror of current atomic weaponry makes the bombs dropped on Japan during World War 2 look tiny by comparison. The present-day scale is incomparable to what was in the past. The only horror anyone would ever be spared if another bomb ever fell is the radiation sickness wouldn’t impact the remaining survivors. The difference is because modern nuclear weaponry utilizes fusion. The differences are the same for power plants using fissile material like U-235 versus some hypothetical fusion-based power plant.

Making controllable stars on earth is interesting and I’m shocked to see a fund of this size pursuing any level of investment into it. Hard to tell where that money will be coming from, but fusion is probably one of the only realistic outs of the climate crisis that even exists. The reason I say that is because we’ll need something resembling an infinite source of power to perform the sequestration of the excess hydrocarbons that have been dumped into the oceans and atmosphere. Companies like carbon engineering, which was purchased by big old Warren Buffett’s OXY 0.00%↑ for about a billion dollars are an example of potential industrial carbon sinks, but they are energy intensive, and the energy density of renewables just isn’t up to snuff. Moving on…

Teitur Trophics is another one that’s pretty interesting. They’re working on therapeutics applicable to what ClearPoint Neuro is doing- FTD, Huntingtons, and Parkinsons. That may be a future partner in the making, we’ll see which route for delivery they decide to take as they proceed. Right now, it looks like they’re in a preclinical stage. One of my favorite things about ClearPoint is that it’s a solid gravity well for these early-stage resource constrained therapeutic companies in neuro. They save these companies so much money by lowering the risk of delivery failure. I suspect it’s why it’s not surprising to see this supernormal rate of clinical success that’s being observed. In just 5 years’ time, the progression of that portfolio is night and day. It’s not even recognizable and we’re getting so close to seeing the first huntingtin silencing program work. You don’t really feel the change day to day because the temperature of the water is just so slow to change, like having a broken heater. But the water heater is working, and those who take their time to explore can see at least some of what’s coming.

The last one I’ll talk about is a game studio called fast travel games. BlackForge, Project Demigod, Apex Construct, Budget Cuts 2 Mission Insolvency, and the midnight walk (that one’s coming out this year). These are all VR games made by their portfolio company and they look like a ton of fun. The midnight walk looks and sounds especially ominous and spooky. I’m going to have to try that one out if only just to see what happens.

There’s a lot more of these portfolio companies. Some are even public. But If I was to describe most of what I’m seeing… they’re dedicated to making new therapies, stars, and all other sorts of interesting technologies with scope that falls over things like semiconductors, climate tech, and medical care for various conditions like endometriosis. It’s as if a group of people made a saint motel dedicated to saving the world and revitalizing the Swedish economy with a set of technologies that require an exceptionally long road to develop… and at least some of the products look promising without too much investigation or struggle. It will be fun to follow Cellevate if companies like Bayer actually condense their requisite biomanufacturing footprint from that product. For the larger scale gene and cell therapies… this is basically going to be something that’s a necessary part of the upstream supply chain. Gene and cell therapies are still in their infancy and the amount of product that will be required to manufacture is immense.

The supply chain is just one part though, and I spent a while trying to understand the components feeding into an affective neuroscience medical technology device company to understand what Joe Burnett was building. To get to a point where you can rapidly prototype a therapy and walk yourself through clinical trials with a pre-established set of technologies is an evergreen structure to work within... There’s always something new to pop out of the magician’s hat. There’s like 1700 monogenic neurological disorders and diseases.

But to make the set of rarer diseases commercially viable outside of just having incentive programs like the FDA’s priority review voucher system, you need to have this really high hit rate for delivery. Otherwise, the typical failure rate of neuro assets will act like a high-pass band pass filter where the juice isn’t worth the squeeze for some of the rarer conditions. AADC deficiency may never have been studied as early as it was if it weren’t essentially just Parkinson’s disease for children. In part the reason I suspect we currently see a fair amount of crowding in some of these neuro indications is the potential volumes of whoever gets the job done, but it’s the tail of everything behind it that may come that’s beautiful. The amount of investment pointed at these gene and cell therapies is astronomical and the intersection of the neuro assets which was funneled down into this tiny little regulatory monopoly with ClearPoint held up by the physical construction of a cannula (due to the impact it has on pharmacokinetics) was always a fascinating thing to me… It is the fulcrum upon which to lever something of unknown and growing size.

That the seeding of these products creation and commercialization is to be sown by such a small seeming asset is amazing when you really think about it... Everything that has happened and been sacrificed to get to where they are today will have been worth it if they can just get a single one of those farfetched dreams to be real. Not a pilot or a prototype created out of some cutting-edge technical theory which is later abandoned, but the creation of something important. Like Industrifoden swinging for fusion power.

Is that FLCL?