Disclosure: I own shares of AirIQ - CVE: IQ

I’ve been holding out on you…

Normally when I writeup something, it’s usually a company I started researching within the last 3 months. AirIQ, however, I’ve owned for over a year now. The stock has done well, and my first purchases are, as of today, up by 71%.

At one point I had aspirations to purchase roughly 1% of this company, but as the stock has run higher this dream has gotten away from me (I’m poor) as it would require too much concentration on my end, and there’s no shortage of competing ideas in today’s market.

But that’s enough bragging…

AirIQ Inc.

Description -

“AirIQ's solutions allow commercial businesses to reliably, effectively and efficiently monitor assets in near real time. The Company develops iOS and Android mobile and web-based applications, and cloud-based solutions that stand-alone or that can be readily integrated with existing software. AirIQ solutions are mixed fleet capable and provide fleet reporting, maintenance, compliance, safety and analytics utilizing multiple hardware options including a fully integrated video telematics camera solution and a battery powered solution for non-powered assets.”

First encounter

Unsurprisingly, Paul Andreola was the first to surface this idea to myself (it’s a little hard to beat him to any Canadian name given small cap discoveries manually tracks every single filer on SEDAR).

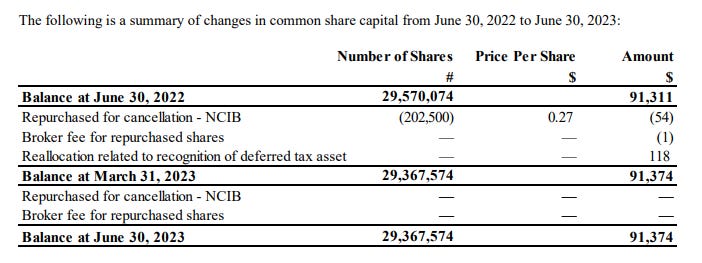

When I opened their management discussion and analysis, I was surprised to find that this company has had an active NCIB for several years. Now the buybacks have been paltry, with their latest buyback utilization recording NIL, but it did signify there is at least some form of minority shareholder alignment with management.

The second thing that stood out was they were carrying a fairly sizeable net cash position, which at the time was around 20% of their market cap (which is roughly where it stands today). This put their EV/FCF yield into the teens, which is pretty nice for a growing company that predominantly earns their money from recurring sales.

It didn’t take long from there to discover an upcoming catalyst (a long deferred ELD enforcement coming to fruition in Canada) that is currently in the process of playing out as evidenced by recent hardware sales growth.

Drivers of recent performance

Quebec delayed enforcement until June 1st (see above)

Busses which operate in Ontario will be temporarily exempt from ELD requirements until July 1, 2023.

AirIQ partnered with Assured Techmatics (a distributor) to begin selling the “Apollo ELD with AirIQ Fleet (link to app)” into the American market. Assured Techmatics then partnered with CalAmp to sell the Apollo ELD shortly thereafter (NASDAQ: $CAMP) which has roughly 10,000,000 installed devices, serving some of the largest company fleets in America.

Latest acquisition (March, 2023) was for 1,000 devices which will generate approximately $325,000 CAD of ARR.

Purchase price of $175k CAD, which was entirely deducted from AR owed by a reseller.

This transaction represented roughly 8% ARR growth. From my conversation with Michael Robb, this was a mix of devices (it wasn’t just ELD’s for long haul trucks) and there was on average more than 1 device per vehicle. I’m unaware if this is representative of their take on average, but if it is, this implies that AirIQ’s current fleet size is around 12,200 vehicles.

Price

Despite the runup, the stock hasn’t experienced a tremendous amount of multiple expansion. By my estimates, the stock is trading around 10-12x forward earnings, which is roughly where it was a year ago.

At present, EV/EBIT is probably the most appropriate relative metric to track without making adjustments as anything incorporating tax will show TTM earnings being significantly higher than they are on a go forward basis due to the recognition of a deferred tax asset of $2.83mm CAD.

.

Of note, there are significant existing NOL’s that can be used to shelter future earnings from taxes.

Development of a potentially large catalyst

Remember CalAmp from earlier, who formed a distribution agreement with Assured Techmatics to market the Apollo ELD along with AirIQ’s software? Well, over the last two years, CalAmp has essentially collapsed under the weight leverage and lack of earnings. Its enterprise value is currently 20x greater than its market cap, while the stock is trading at < 1x EV/S.

The stock isn’t cheap, the company is just going bankrupt. CAMP 0.00%↑ has over $200mm USD of loans coming due in less than 2 years with $38.5mm of cash on hand, and ongoing operating losses.

This is a potential opportunity for AirIQ. This is because CalAmp’s customers and assets have a significant degree of overlap with AirIQ’s core operations. The description of CalAmp is as follows:

“CalAmp (Nasdaq: CAMP) provides flexible solutions to help organizations worldwide monitor, track and protect their vital assets. Our unique device-enabled software and cloud platform enables commercial and government organizations worldwide to improve efficiency, safety, visibility and compliance while accommodating the unique ways they do business.”

This is not substantially different than how AirIQ describes their business, which I will restate.

“AirIQ's solutions allow commercial businesses to reliably, effectively and efficiently monitor assets in near real time. The Company develops iOS and Android mobile and web-based applications, and cloud-based solutions that stand-alone or that can be readily integrated with existing software. AirIQ solutions are mixed fleet capable and provide fleet reporting, maintenance, compliance, safety and analytics utilizing multiple hardware options including a fully integrated video telematics camera solution and a battery powered solution for non-powered assets.”

Should CalAmp’s lenders begin to sell off these operations to recoup their losses, AirIQ has the potential to pick up a whole truck load of distressed assets, and they have the cash on hand to do so.

It’s important to note this is entirely speculative, albeit it makes a good deal of sense to me with CalAmp’s future bankruptcy all but certain and their market overlap.

That’s about all I have to say for now. Until next time,

-Left

CalAmp filed on Monday June 3rd. What do you think happens now?

What do you think of the recently presented results? From my point of view they are good. On the other hand, yesterday it corrected 19%